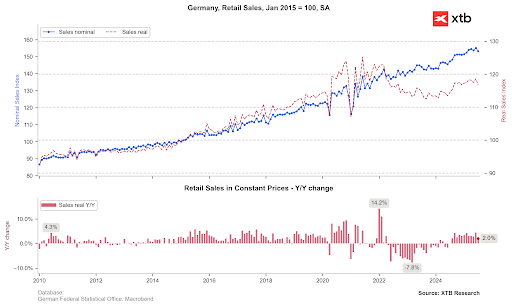

EURUSD began today’s session with a degree of weakness, following the release of poor German retail sales data and lower producer inflation (or rather, deflation). German retail sales fell by 1.5% month-on-month and rose by only 2.0% year-on-year, a significant slowdown from the nearly 5% growth seen in June. Such weak data undermines the narrative of a robust European consumer.

Additionally, data from France and Spain was released. French inflation remains extremely low at 0.9% year-on-year, although it did see a monthly increase of 0.4%. In Spain, CPI inflation remains elevated at 2.7% year-on-year but failed to rise as expected to 2.8%.

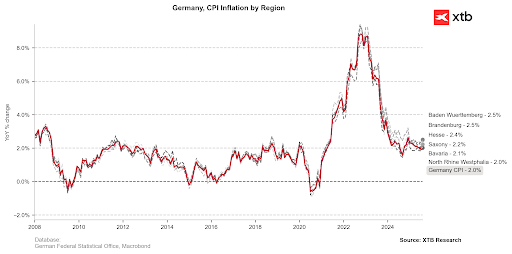

However, we have seen a significant surprise from individual German states, where data has come in notably above expectations, suggesting a considerable rebound in August’s CPI inflation. These figures will be released in the early afternoon. For instance, inflation in Brandenburg rose to 2.5% year-on-year from a previous reading of 2.2%. Almost all states saw inflation come in higher than previous levels, though there were virtually no month-on-month changes after the last strong rebound.

Expectations for German inflation point to a rebound to 2.1% year-on-year from 2.0%, with a month-on-month reading of 0.0%. However, there is room for an upside surprise, which should reinforce the ECB’s stance to hold interest rates at its upcoming meetings.

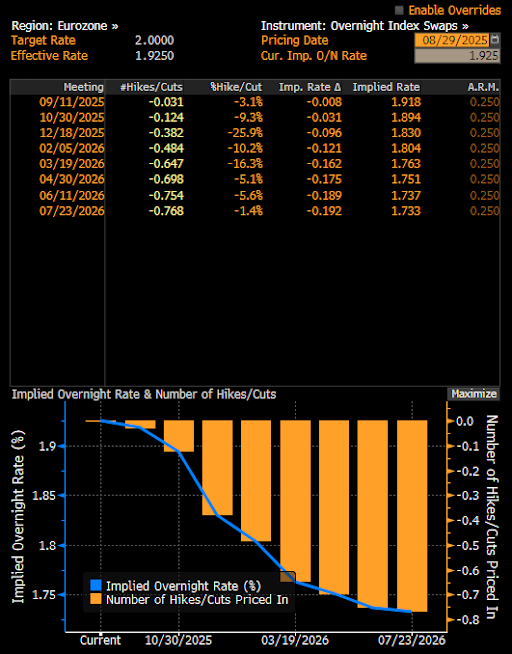

Expectations indicate an almost zero probability of a rate change at the September meeting. For December, the market is pricing in just under a 40% probability. Source: Bloomberg Finance LP, XTB

EURUSD has recovered almost all of its morning weakness thanks to the higher data from the German states. It is worth noting that the pair has reacted to the 1.1600 level four times in recent weeks. Nonetheless, at 1:30 PM BST today, we will see the US PCE inflation data, which could set a new tone for the pair. If inflation proves to be higher than expected, it could temper the strong market expectations (85%) for a Fed rate cut in September. Conversely, if it turns out that tariffs do not have as much of an impact on consumer prices as some Fed members have suggested, confidence in a September move could increase. This might encourage the pair to re-test the 1.17 level, which marks the upper boundary of the descending trend channel.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.