Trade of The Day – US500

Facts

- Wall Street indices pulled back on September 25, shortly after the release of stronger-than-expected U.S. GDP and durable goods orders data, along with lower jobless claims.

- Donald Trump stated that Federal Reserve interest rates should be cut even as data points to economic growth.

- The US500 contract rebounded slightly after declines and was trading flat as of 9:35 AM GMT.

Recommendation

- Long position on US500 at market price

- Take Profit: 6730

- Stop Loss: 6560

Opinion

Stronger U.S. macroeconomic data should support a bull market in equities. Yesterday’s comments from Donald Trump, in a sense, suggest that next year the Fed will not “fear cutting rates” despite robust U.S. economic data and will show greater tolerance for inflationary risk. The priority would shift toward lowering debt servicing costs. For the equity market, such a scenario appears optimistic. While Powell and the Fed may “delay” easing this year, it still seems somewhat inevitable. Strong U.S. data should, overall, be welcomed by the market.

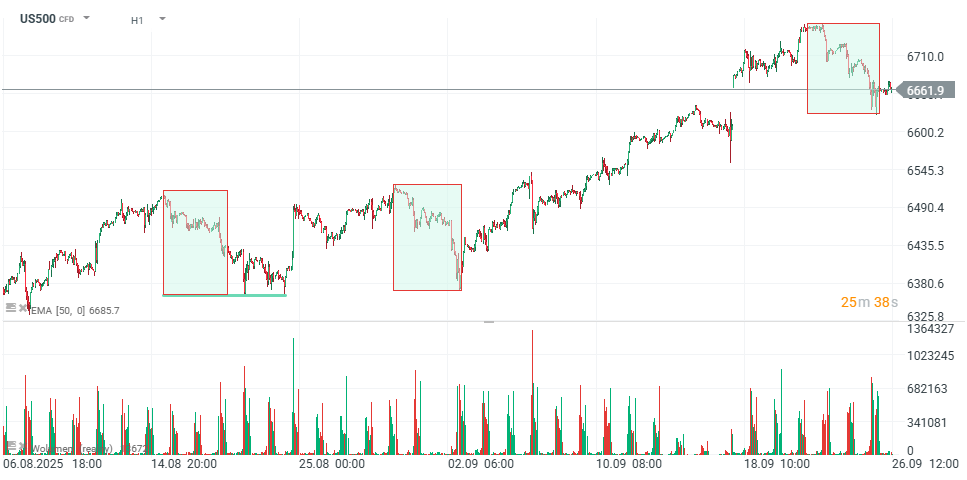

Concerns remain around the potential for a government shutdown, which occurred during Trump’s previous term. However, if one is avoided, we can expect equities to resume their upward trend. Looking at the chart, the two previous corrections—in August and at the turn of August and September—had a similar scope to the current pullback. If the market rebounds from the present level, we can consider the decline as another 1:1 correction within the broader uptrend. We therefore recommend taking a long position on US500 at the market price, with a target of 6730 points and a stop-loss at 6560 points, determined using price action methodology.

Source: xStation5