WTI price struggles amid growing demand concerns, fueled by fears that US tariffs could negatively impact the global economy. President…

Read More »Energies

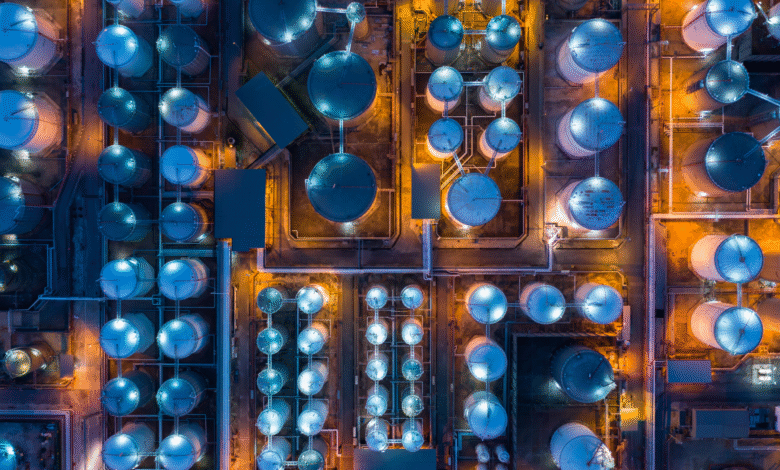

Commodities include agricultural products such as wheat and cattle, energy products such as oil and natural gas, and metals such as gold, silver, and aluminum.

WTI crude oil futures hovered around $69 per barrel on Friday, holding onto a decline of more than 1% from…

Read More »Brent crude oil futures hovered below $72 per barrel on Friday, holding onto an over 1% drop from the previous…

Read More »September Nymex natural gas (NGU25) on Thursday closed up +0.061 (+2.00%). Sep nat-gas prices on Thursday recovered from a 3.25-month…

Read More »September WTI crude oil (CLU25) on Thursday closed down -0.74 (-1.06%), and September RBOB gasoline (RBU25) closed down -0.0282 (-1.28%).…

Read More »WTI crude oil futures fell to $69.5 per barrel on Thursday, retreating from six-week highs after a three-day rally, as…

Read More »September Nymex natural gas (NGU25) on Wednesday closed down -0.097 (-3.09%). Sep nat-gas prices retreated on Wednesday due to a…

Read More »There are two key “outside markets” that commodity traders monitor closely to help them determine the daily price direction of…

Read More »WTI price hovers near five-week highs amid rising supply concerns. President Trump threatened to tighter deadline for Russia to end…

Read More »WTI crude oil futures hovered above $69 per barrel on Wednesday, holding at a five-week high, supported by supply concerns…

Read More »