Chart of The Day – EUR/USD

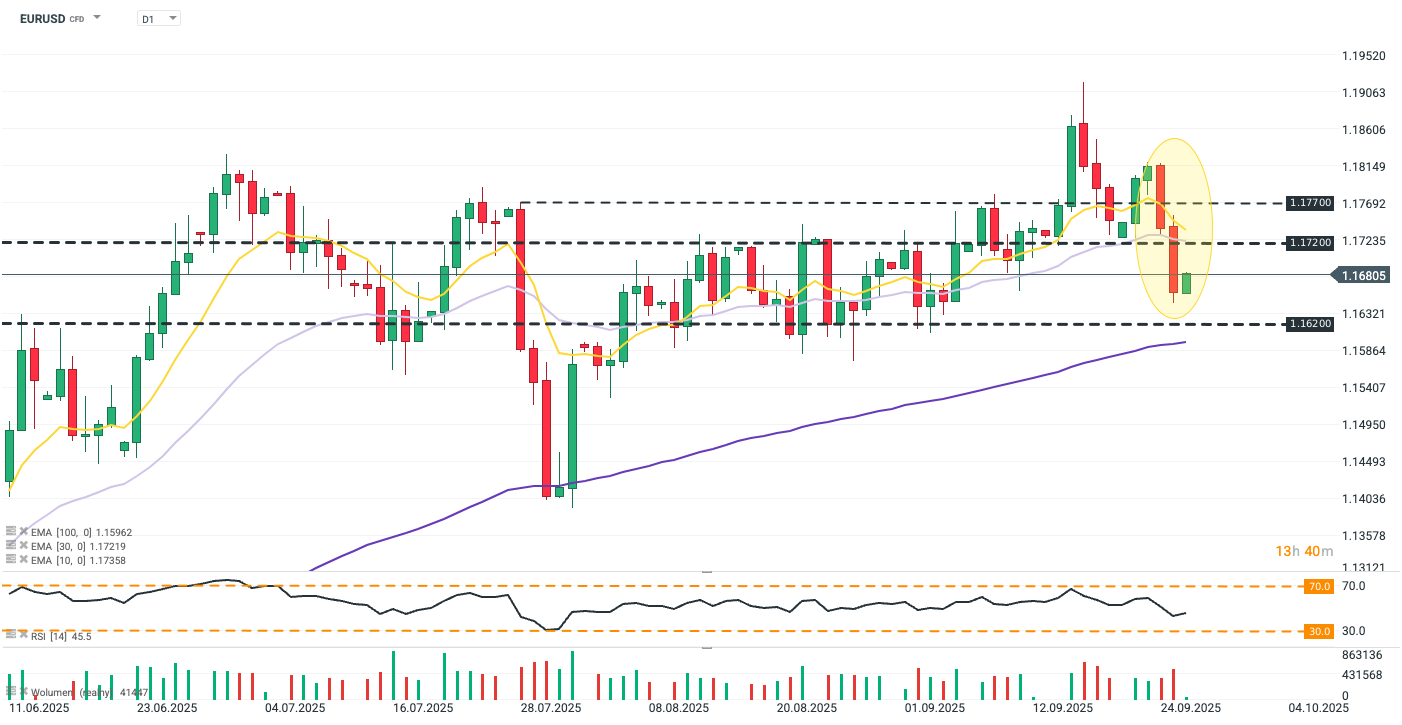

The euro is today the strongest G10 currency, rebounding about 0.15% against the dollar after two days of the deepest correction in two months. Nevertheless, EURUSD still trades below the psychological level of 1.1700, and the recent upward trend may be challanged by the latest U.S. GDP data and Donald Trump’s new wave of tariffs.

EURUSD lost 1.3% over the past two sessions, the steepest decline since the sharp selloff at the end of July in reaction to the EU–U.S. trade agreement. The pair plunged below the 30-day exponential moving average, but held safely above key support at 1.162. The scale of today’s rebound, however, will largely depend on the PCE report. Source: xStation5

What is shaping the EURUSD today?

- Annualized U.S. GDP in Q2 was revised upward from 3.3% to 3.8%, the strongest reading since Q3 2023. A major driver was a tariff-driven boost in net exports, but private consumption — the main engine of the U.S. economy — also strengthened (revised from 1.6% to 2.5%) despite inflation and labor market concerns, as well as weak survey data.

- The show of strength from the American consumer tempers expectations of further Fed rate cuts, especially combined with the latest labor market data, thus supporting the USD. Jobless claims unexpectedly fell below the 4-week average (218k vs. forecast 233k, prior 232k), easing fears of a rapid deterioration in the labor market. Overall, the data supports caution on the Fed’s side, but tension and uncertainty will grow ahead of today’s PCE report and next week’s NFP.

- The core PCE index is expected to remain at 2.9%, and an in-line print should help the euro catch its breath after recent losses. On the other hand, uncertainty about Fed policy could amplify the market’s reaction in the event of higher-than-expected inflation, especially given Jerome Powell’s recent hawkish remarks about no risk-free rate path.

- Donald Trump has announced a new round of tariffs effective October 1: 100% on branded pharmaceuticals, 50% on kitchen and bathroom cabinets, 30% on upholstered furniture, and 25% on trucks. However, details about possible exemptions are lacking — important in the context of EU and Japan agreements, which assumed no additional tariffs beyond those negotiated. The pharmaceutical tariff will not apply to companies that have begun building production lines in the U.S. (e.g., AstraZeneca, which announced a new plant in Virginia).

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.