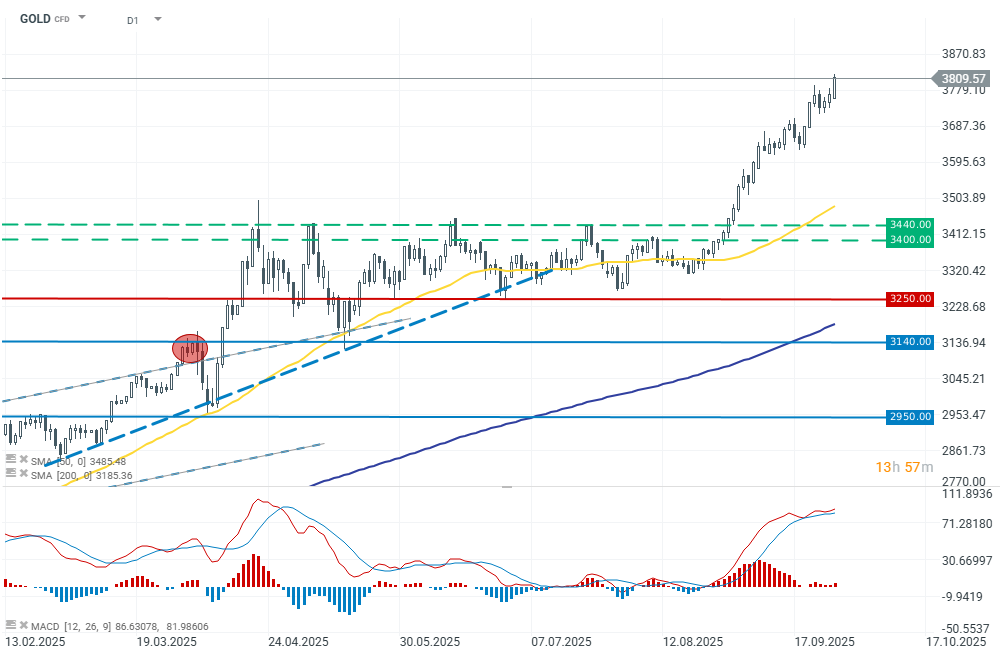

Chart of The Day – Gold

Gold is gaining 1.10% today and breaking above $3,800 per ounce. December futures are also rising to $3,840. The main reason for such strong capital inflows at the very start of the week is the flight to safety amid uncertainty linked to the looming U.S. government shutdown, reinforced by expectations of Fed rate cuts and a weaker dollar. Silver and platinum are gaining even more.

Currently, the market is pricing in a 90% probability of a 25 bp cut at the next meeting and a 68% probability at the December meeting. The risk of a U.S. government shutdown remains a short-term factor. Funding expires at midnight on September 30 if politicians fail to reach an agreement. Markets still price elevated shutdown risk, though lower than over the weekend. Republicans have assured they will not make concessions on passing a short-term funding bill. Tensions escalated when the White House Office of Management and Budget last week instructed agencies to prepare mass layoff plans in the event of a shutdown.

At present, Republicans are trying to push through a so-called “stopgap” bill until November, while Democrats want to reverse recent healthcare/Medicaid cuts before supporting legislation. Congressional leaders are set to meet with President Donald Trump for mediation. A shutdown could delay the release of key macro data, including labor market figures later this week.

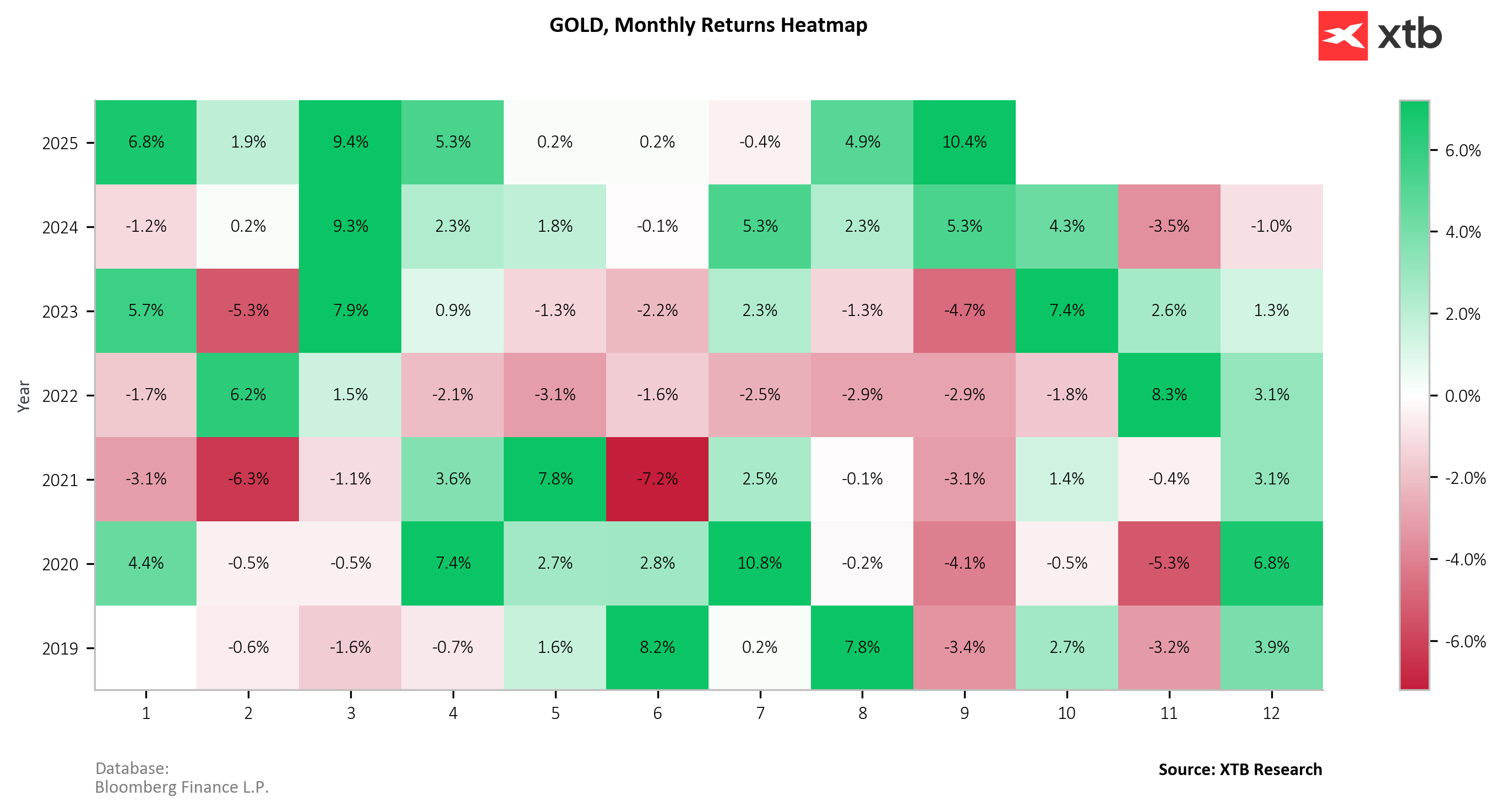

With gold up more than 45% year-to-date, over 10% this month, and the dollar down more than 9.50% this year, concerns about de-dollarization and skepticism toward Fed independence are boosting gold’s appeal as a safe haven. Strong demand for gold continues among institutions and central banks. Singapore and Hong Kong are expanding vaults, while China is increasing its reserves.

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.