Coffee Rebounds 2.5% on Falling ICE Inventories

Futures on Arabica Coffee (COFFEE) on ICE are trading nearly 2.5% higher today, making them the best-performing agricultural commodity. The primary driver of this rally is a significant drop in coffee inventories at the Intercontinental Exchange (ICE).

- This sharp decline in ICE stocks is fueled in part by the 50% U.S. tariff on imports from Brazil, which is tightening the coffee market. According to ICE data, coffee inventories have fallen to their lowest level in 17.5 months, standing at 601,717 bags as of Tuesday, September 23. A decline has also been recorded in Robusta coffee, with stocks hitting their lowest level in nearly two months.

- In the short term, the coffee rally has extended to Robusta, driven by forecasts of heavy rains in Vietnam’s Central Highlands, expected to last until the end of the month and potentially damaging beans entering their final development phase before harvest.

- On the other hand, Brazil’s meteorological agency Somar Meteorologia reported that rains in Minas Gerais are set to continue through the week. Should these rains persist longer, Arabica prices could face technical resistance, despite falling ICE inventories.

Last week, coffee futures pulled back to one-month lows on forecasts of increased rainfall in Brazil’s key Minas Gerais region. However, the latest ICE data has reignited buying interest and speculative demand in coffee.

COFFEE Chart (Daily Interval – D1)

From a technical perspective, prices have broken above the 50-day EMA on the daily chart after recently testing the 200-day EMA (red line), following a sharp decline from the 420 to 350 area. The price has now moved beyond the 61.8% Fibonacci retracement of the downward wave that began earlier this year, with a potentially important supply test ahead near the 390 zone.

Source: xStation5

CFTC Commitment of Traders (CoT) Report

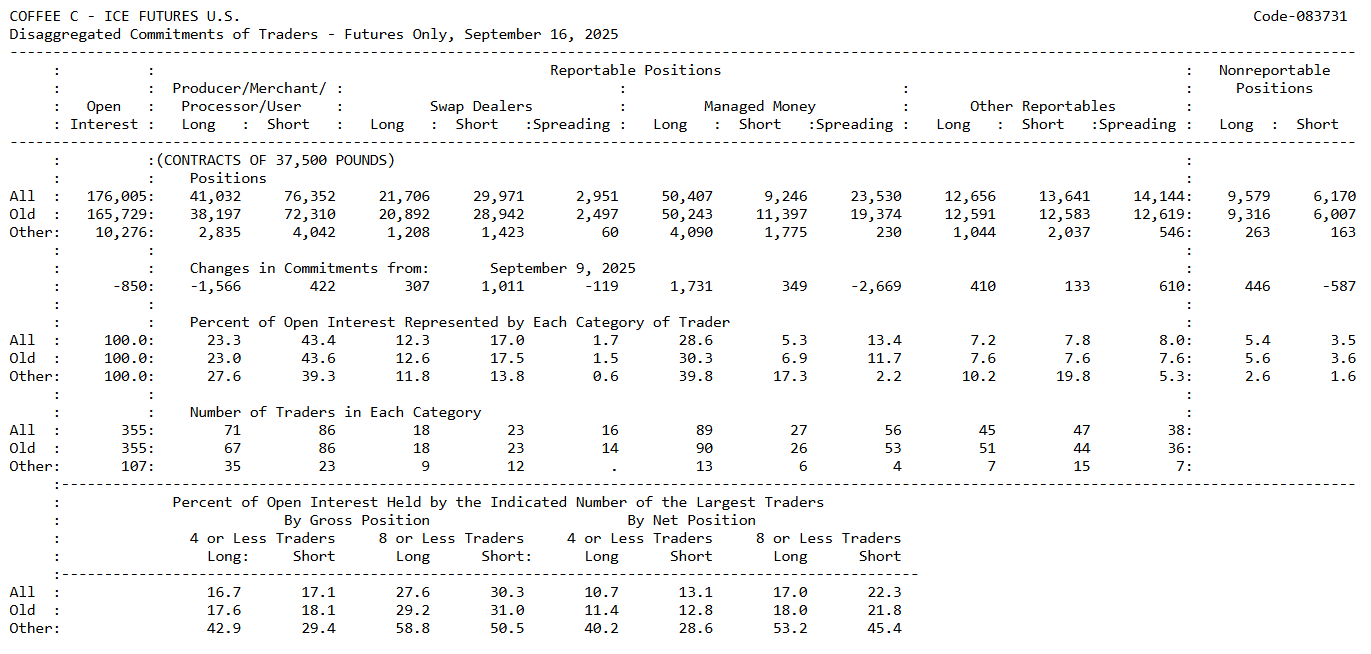

The latest CFTC report on the coffee market (as of September 16) highlighted notable differences in positioning between large speculators (managed money) and commercials (producers, exporters, processors).

Commercials:

- Hold more short positions (76,352 contracts) than long positions (41,032 contracts).

- This is a classic setup, with producers and traders hedging future harvest sales.

- Net positioning is strongly on the short side, reflecting hedging against potential price declines.

Managed Money:

- Hold 50,407 long contracts versus only 9,246 short contracts.

- Additionally, 23,530 contracts are listed as “spreading” (neutral strategies).

- Net positioning remains heavily long, with a ratio of about 5:1 longs vs. shorts.

- Compared with the previous week, managed money increased their longs by +1,731 contracts.

In summary:

- Commercials are playing defensively, using higher prices to hedge against risks of falling prices—normal behavior for producers.

- Speculative funds clearly expect further price increases, maintaining a strong long bias.

- However, if producers continue aggressive hedging, it could undermine the foundations for future sharp rallies.

Source: CFTC

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.