Commodity Talk – Oil, Natgas, Silver And Cocoa

Crude Oil

- Crude oil remains under pressure from an expected supply glut through the end of this year and into next.

- There appears to be no immediate threat to supply, given the lack of signals from the US or Europe regarding the imposition of strict sanctions on Russia.

- Iraq has agreed with the Kurdistan Regional Government to resume oil exports to Turkey via the pipeline running through Kurdistan.

- At the same time, price declines are limited by the strong performance of the US stock market, where new historical highs are being set almost daily, maintaining a positive sentiment about the future of the American economy.

- Turkish oil imports in August fell by nearly 3% year-on-year, which may indicate weakening demand or a reduced willingness to buy Russian oil due to additional tariffs. Conversely, India already faces high tariffs, so it has no reason to reduce its purchases from Russia.

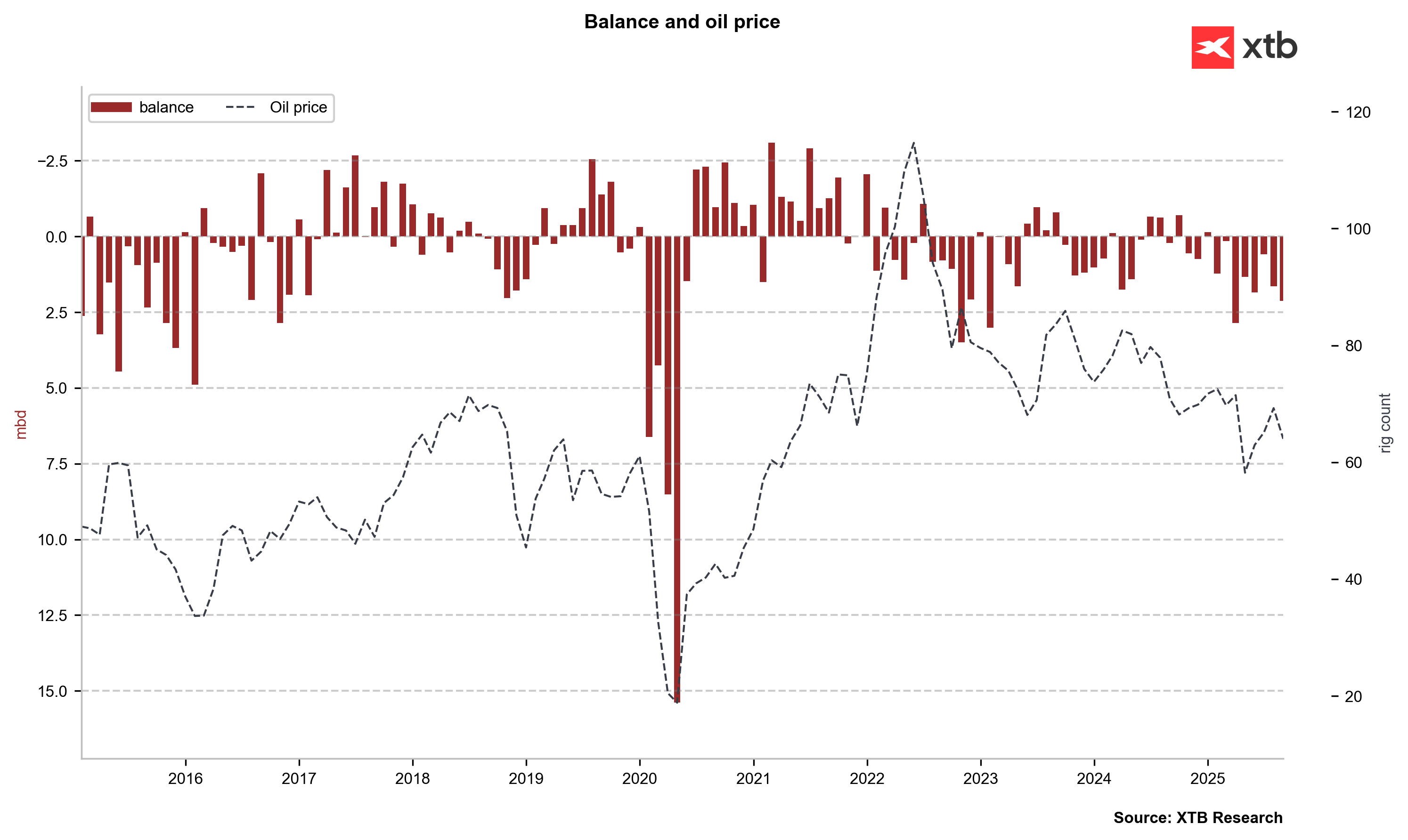

The supply surplus this year is very large, although we have not seen a corresponding significant increase in inventories. Source: Bloomberg Finance LP, XTB

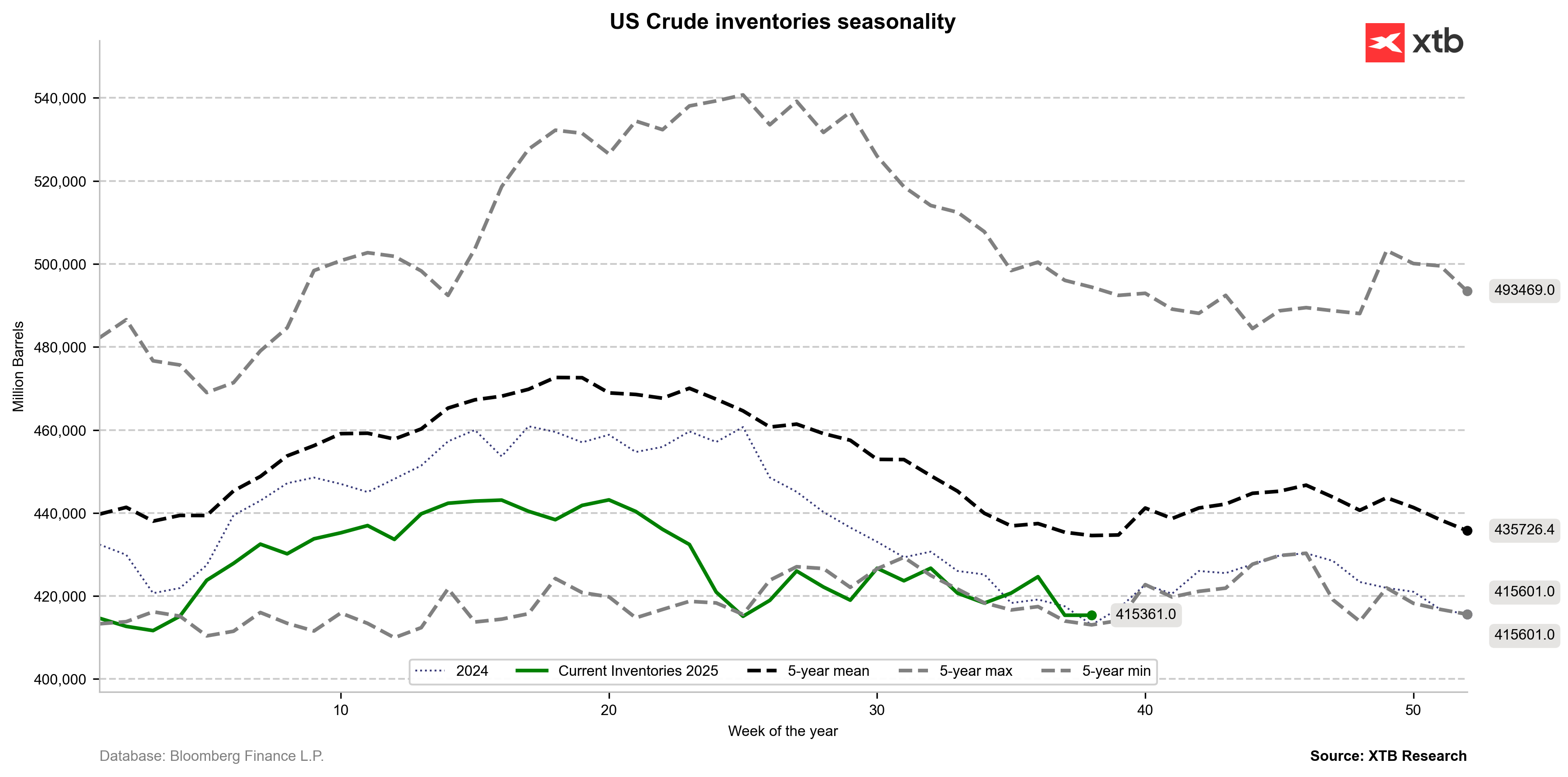

US crude oil inventories remain near last year’s levels and close to their five-year minimum. Source: Bloomberg Finance LP, XTB

Crude oil remains under pressure and is currently testing levels around $62 per barrel. If this support is breached, it could lead to a decline to lower levels around $60, where oil was last seen at the end of May. However, if support holds, a rebound towards the 25-period moving average above $63 per barrel can be expected. Source: xStation5

Natural Gas

- Natural gas prices have returned to a sharp downtrend amid stronger-than-expected inventory builds in recent weeks.

- On the other hand, we are seeing a renewed significant increase in demand, to levels above the five-year average.

- The number of cooling degree days is clearly falling, suggesting that there is no longer significant demand for gas for cooling purposes. Conversely, the number of heating degree days is markedly lower than the five-year average.

- The current weather forecast suggests that the start of the heating season could be delayed.

- US natural gas prices have recently fallen sharply, bringing them in line with the trend set by TTF gas.

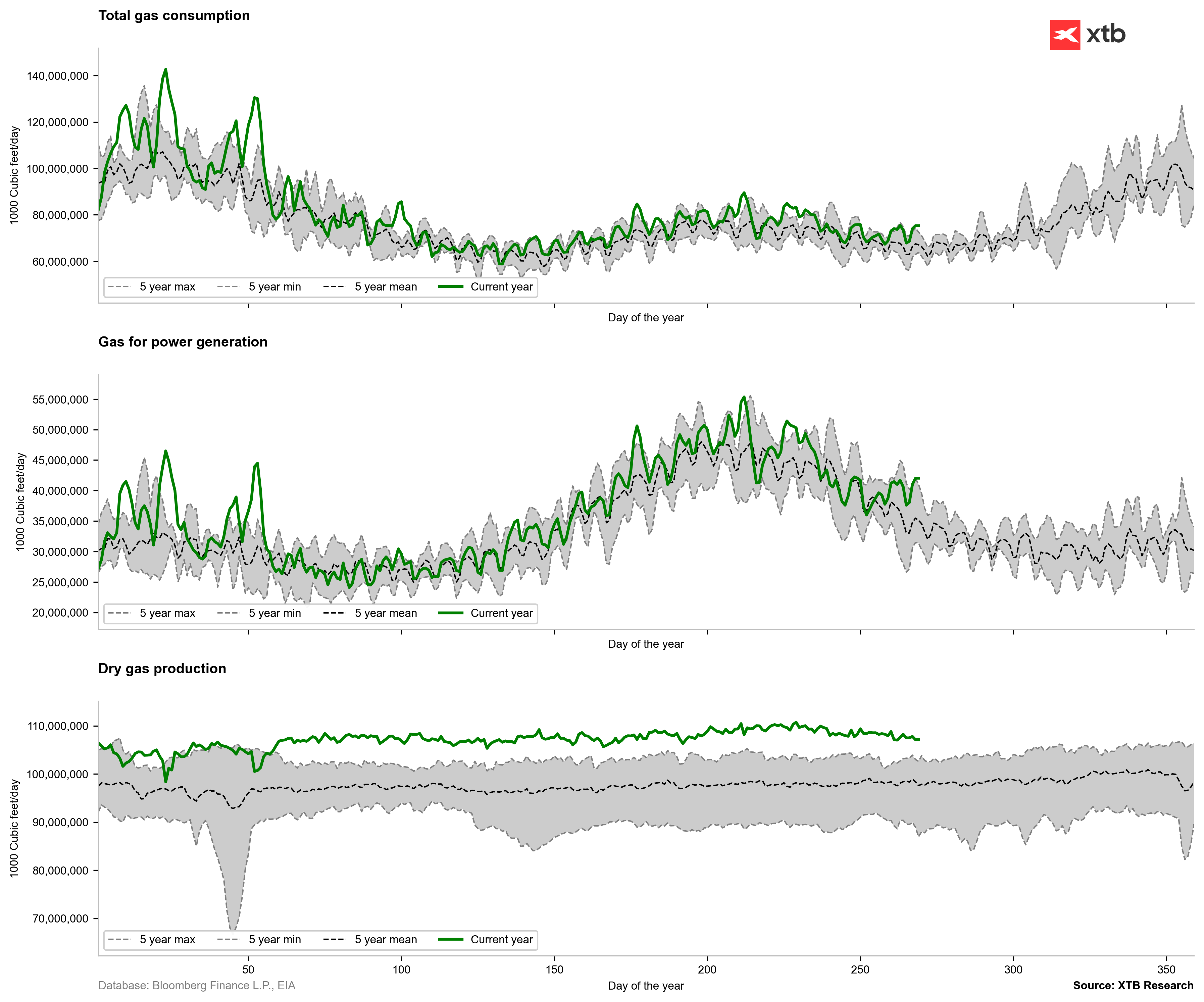

- Although production has dropped slightly in recent weeks, it remains extremely high by historical standards.

Consumption data is surprising, as consumption is slightly above the five-year range, especially in the use of gas by power plants (second chart). However, high production means that the inventory build should still be quite significant. Source: Bloomberg Finance LP, XTB

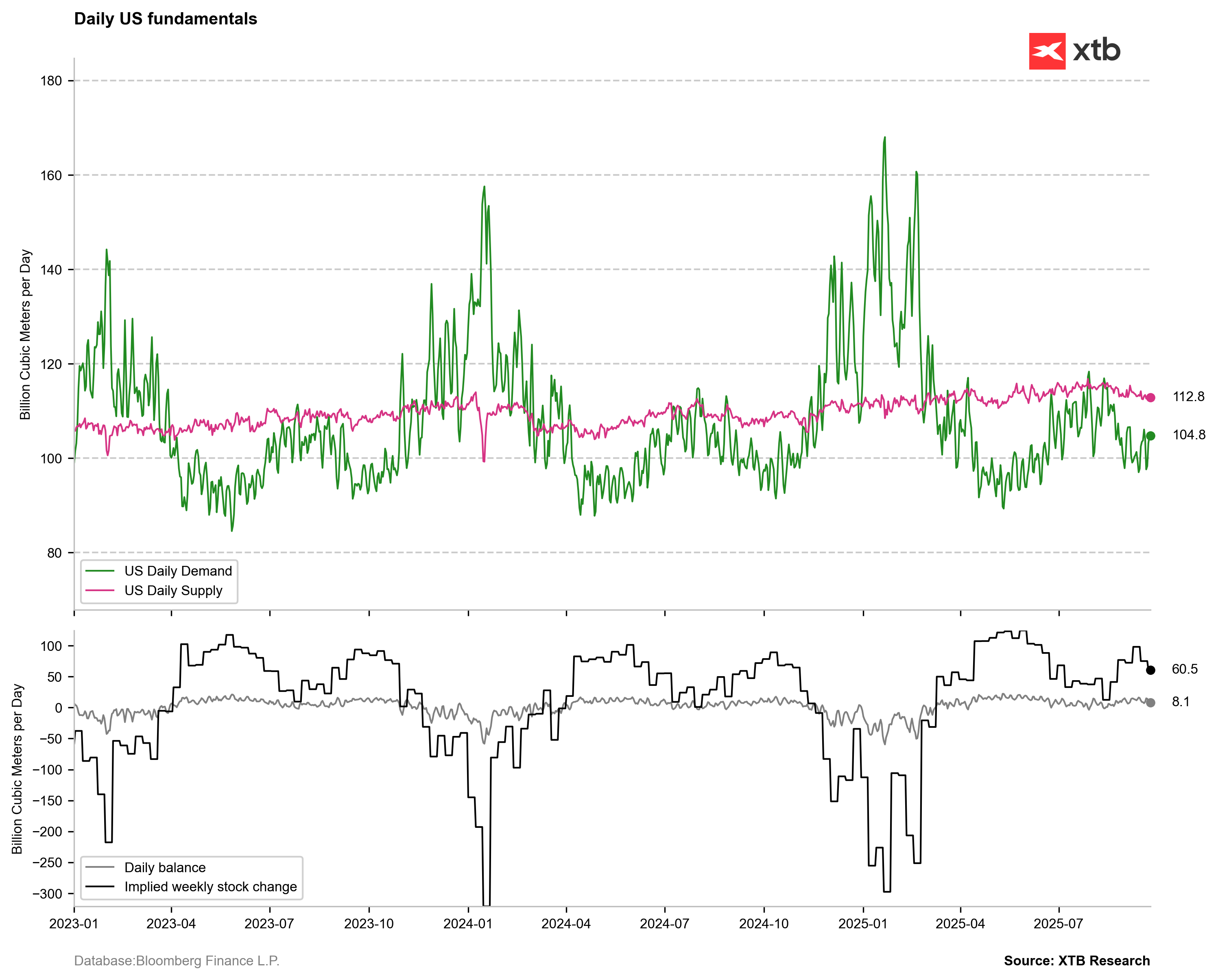

Demand has indeed jumped, but inventory builds are still expected to be quite strong. Source: Bloomberg Finance LP, XTB

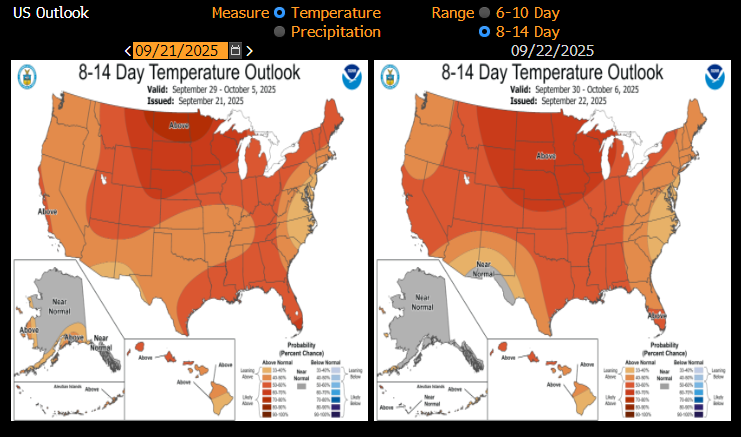

Current forecasts for higher temperatures should no longer boost cooling expectations but rather decrease heating expectations, which is evident in the heating and cooling degree day data. Source: Bloomberg Finance LP, NOAA

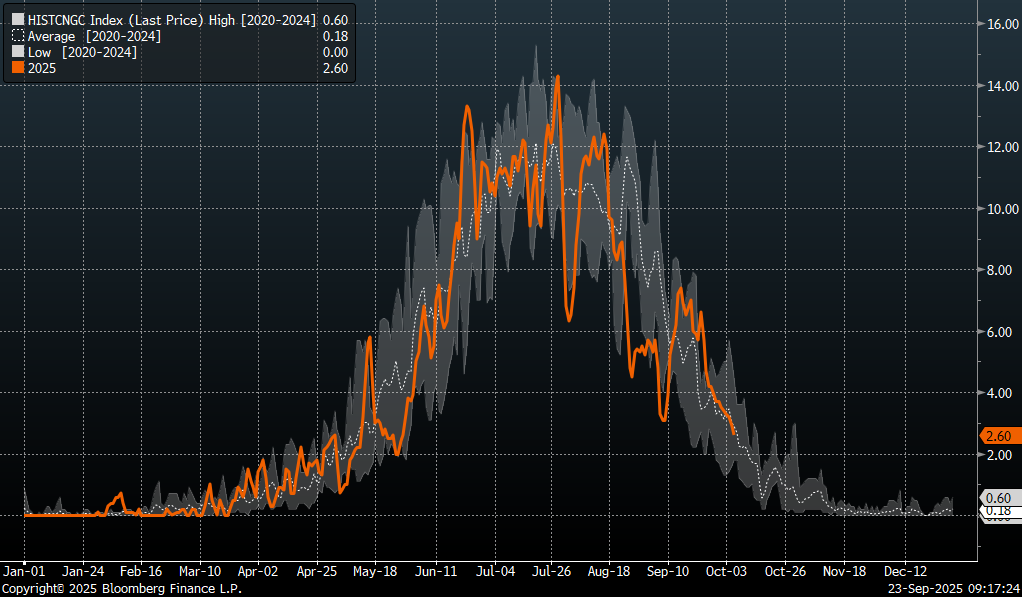

Cooling degree days have returned precisely to the five-year average and are in a strong downtrend. Source: Bloomberg Finance LP

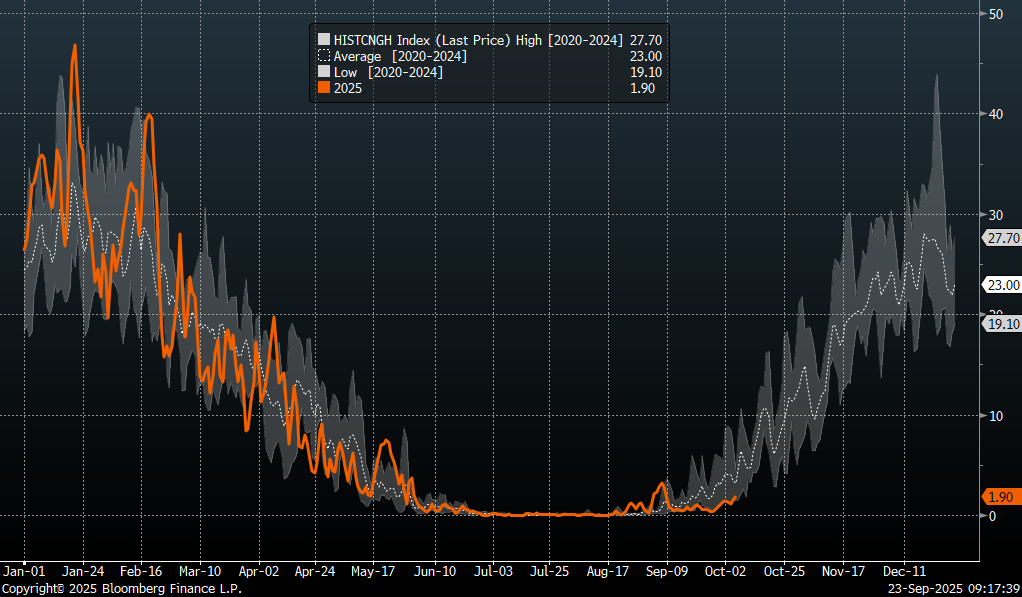

Heating degree days, meanwhile, are well below the five-year average, indicating that current high temperatures are delaying the start of the heating season. Source: Bloomberg Finance LP

Silver

- Silver is having its best year since 2011 in terms of both nominal prices and growth. It has gained over 50% since the beginning of the year.

- The price increase is driven by rising demand for safe-haven assets, with gold’s gains exceeding 40% this year.

- The rally in precious metals was primarily fueled by growing expectations for US interest rate cuts this year, following the Fed’s first cut last week.

- The Fed is now expected to cut rates two more times this year.

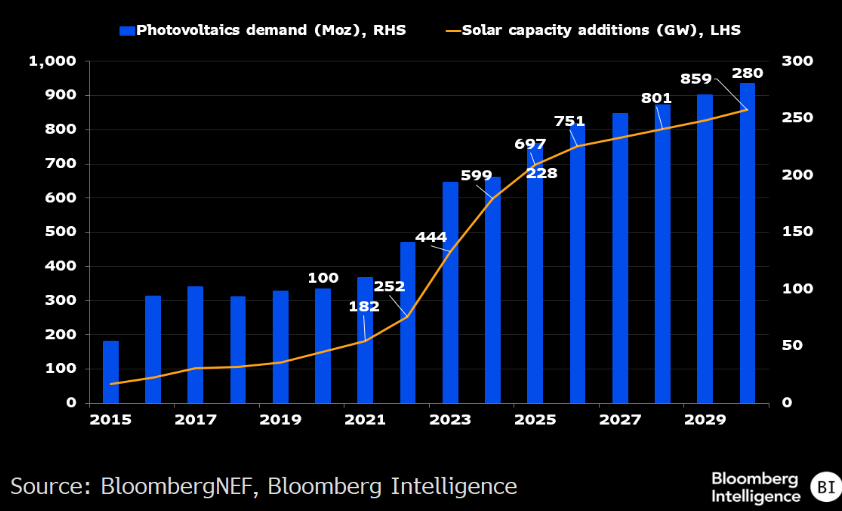

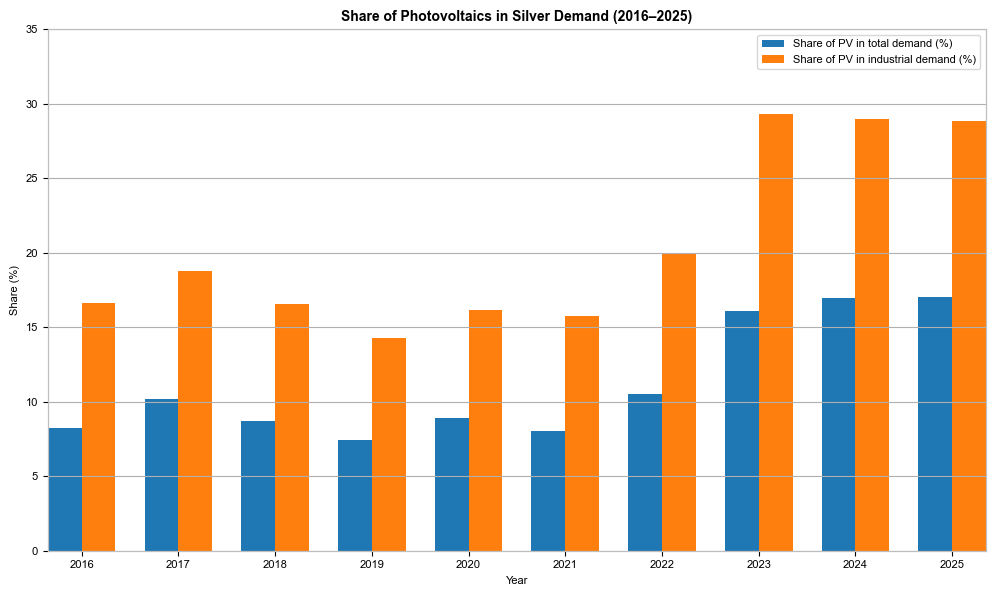

- Additionally, this is the third consecutive year of very strong demand from the photovoltaic sector, although there are some concerns about whether the coming years will be as robust.

- On the other hand, long-term forecasts indicate a continued increase in demand from the photovoltaic sector and its growing importance in total silver demand. Silver’s share of demand from the electric vehicle sector is also rising.

- According to Metal Focus, a firm that collects data on metal market fundamentals, silver has a chance to reach $45 per ounce in the near term, which would act as a psychological barrier. At the same time, $50 per ounce is not ruled out in the coming months.

- Metal Focus also points to a $3,800 level for gold, followed by a period of consolidation, given that Fed rate cuts are now fully priced in.

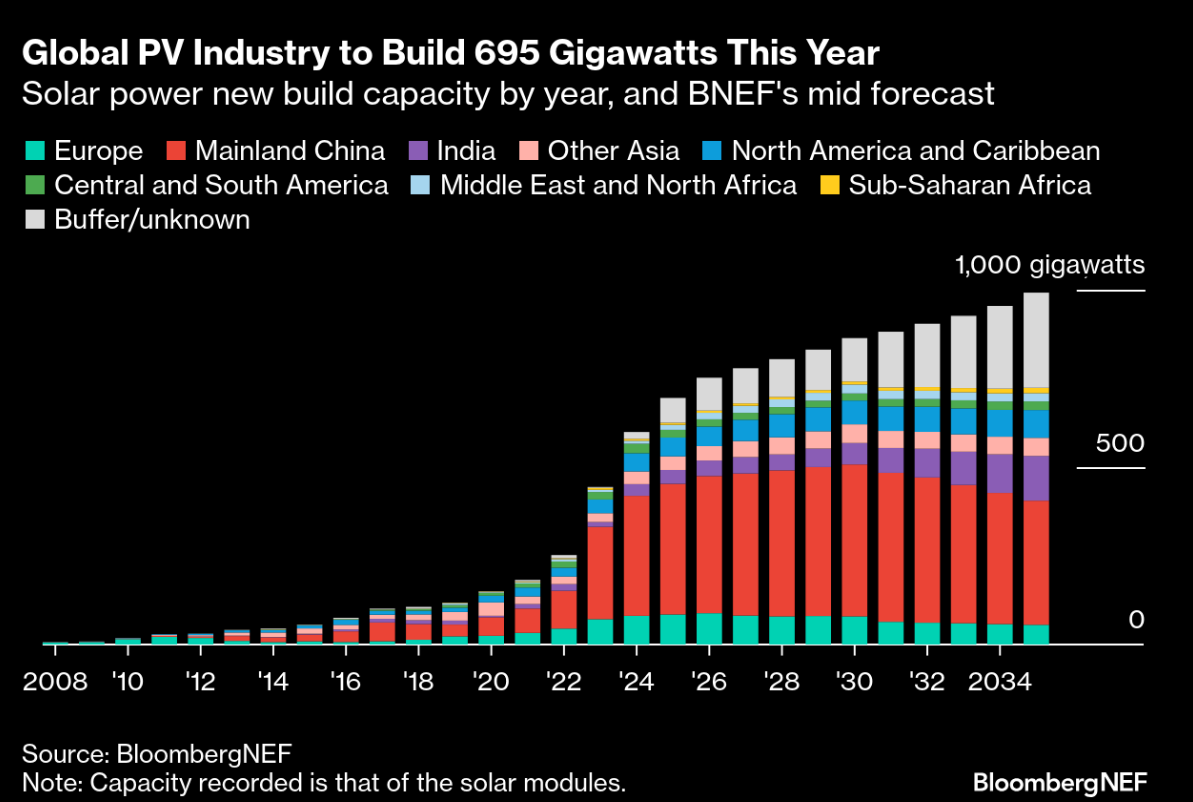

Bloomberg’s forecasts for photovoltaic sector demand are higher than those of the Silver Institute. Moreover, these forecasts indicate a continued very strong growth in demand until 2030. Source: Bloomberg Intelligence

In the coming years, the amount of installed solar capacity is expected to continue growing, although not as dynamically as in 2022-2024. However, Bloomberg itself shows that a large part of the forecast is subject to uncertainty, especially regarding the final destination. Source: BloombergNEF

The share of photovoltaic demand in total demand is already over 15%, but some forecasts suggest it could be over 30% by the end of the decade. Source: Silver Institute, XTB

Cocoa

- Cocoa prices have fallen to their lowest level since November 2024, linked to weather reports from West Africa and rising supply from South America.

- Côte d’Ivoire has recorded significant rainfall, which may improve the outlook for the upcoming harvest.

- Additionally, Mondelez has indicated that the number of cocoa pods is currently 7% above the five-year average, suggesting a potentially good harvest in the coming months. Moreover, farmers remain optimistic about the quality of the pods.

- There are also concerns that high tariffs on Switzerland and Europe could cause a drop in demand for chocolate products in the United States.

- Information has also emerged that in the 2026/27 season, there could be a change in the classification of the second-largest producer. A harvest of 650,000 tons is expected from Ecuador, while Ghana currently produces about 600,000 tons. However, it is worth remembering that Ghana’s production capacity is significantly higher, at around 800,000 tons.

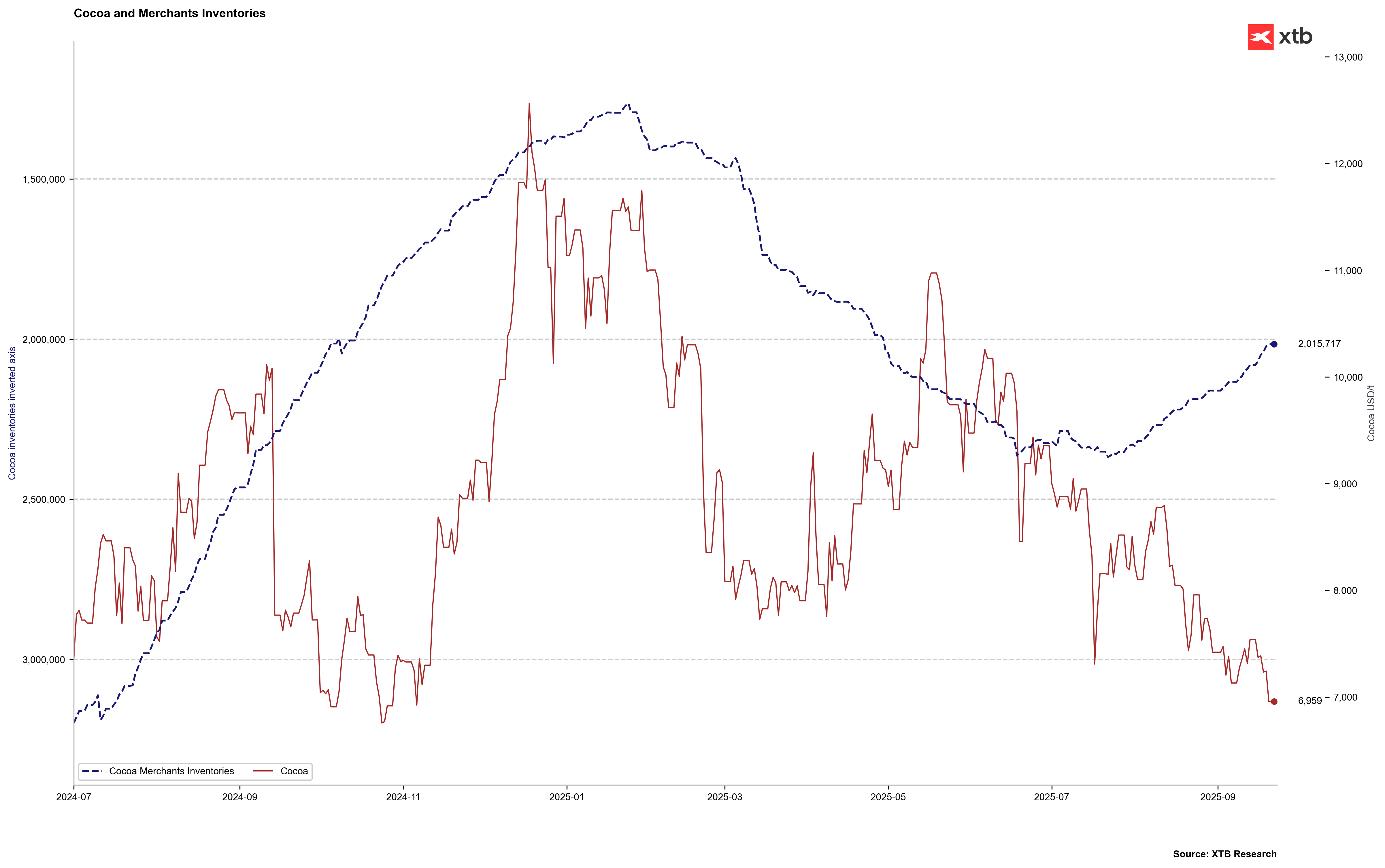

The price of cocoa fell sharply during Monday’s session on September 22, setting a new lower low in the long-term downtrend. The $7,000 zone is an important support level, and looking at the past two years, the price has only fallen below this zone for an extended period in October of last year. The first data on deliveries in early October will be crucial for the continuation or reversal of the trend. Source: xStation5

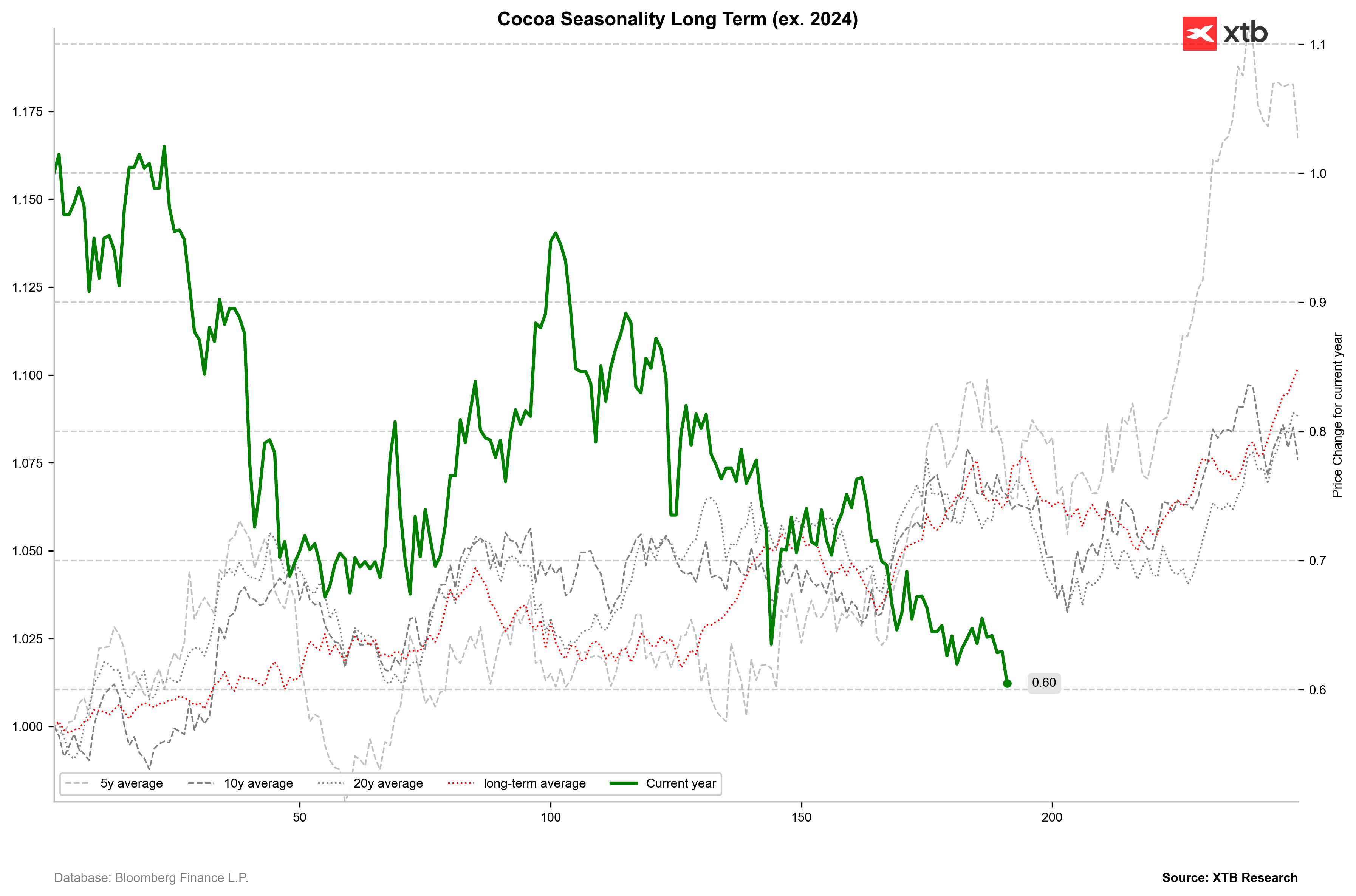

The price of cocoa is in a clear downtrend. Seasonality suggests that a price rebound usually occurs around the 200th trading day of the year, which is related to the start of the harvest season. However, recent data indicate that the season may be better than at least the previous two. Source: Bloomberg Finance LP, XTB

Cocoa inventories have continued to decline recently, but the period when larger deliveries from African countries begin will be key. If inventories continue to fall from October, it will signal persistent supply problems. Source: Bloomberg Finance LP, XTB

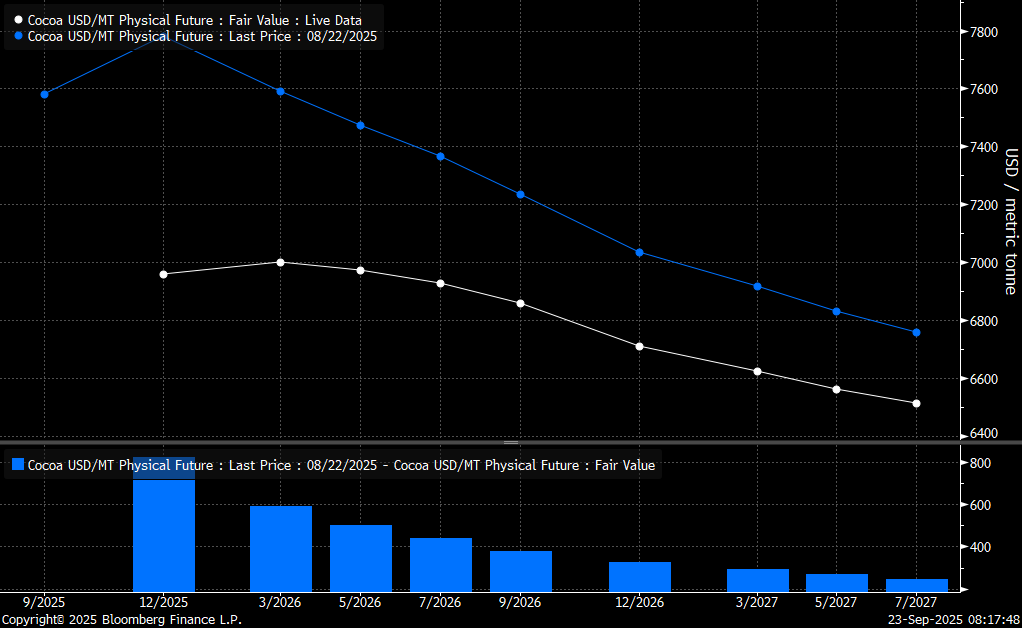

Currently, the cocoa forward curve shows only a minimal backwardation. If this curve continues to lose its short-end strength, it could signal significantly greater market certainty about future supply. Source: Bloomberg Finance LP

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.