EUR/USD eases from highs with Fed Powell and US data on tap

- The Euro extends gains for the tenth day, supported by upbeat Eurozone.

- A mix of trade uncertainty, US debt concerns, and bets on Fed rate cuts is hammering the US Dollar.

- EUR/USD has reached overbought levels at 1.1800, a correction looks likely.

The EUR/USD pair keeps marching higher for the tenth consecutive day. The pair is trading with minor gains around the 1.1800 level at the moment of writing on Tuesday, ahead of the Fed Chairman’s speech on the central bankers’ meeting in Sintra, Portugal and US Manufacturing and Job Openings figures.

The common currency appreciated earlier today, fuelled by an unexpected improvement in the Eurozone preliminary HCOB Manufacturing PMI and better-than-expected German Unemployment figures, while June’s Consumer Prices Index (CPI) remained fairly steady.

The Greenback remains on the defensive, hit by a mix of concerns about the chaotic US trade policy, mounting fears about the country’s fiscal debt, and rising expectations that the Federal Reserve (Fed) will cut interest rates at least twice before the end of the year.

In the trade domain, optimism about Monday’s rare earths deal between the US and China has been offset by US President Donald Trump’s complaints about the discussions with Japan and US Treasury Secretary Scott Bessent’s threats of higher tariffs.

Moreover, uncertainty about Trump’s sweeping tax bill, which is struggling to make its way through the Senate, amid divisions within the republican party about its impact on the US fiscal debt, is adding pressure on the US Dollar.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.24% | -0.22% | -0.84% | -0.01% | -0.10% | -0.32% | -0.54% | |

| EUR | 0.24% | 0.02% | -0.71% | 0.24% | 0.22% | -0.10% | -0.29% | |

| GBP | 0.22% | -0.02% | -0.61% | 0.24% | 0.21% | -0.11% | -0.30% | |

| JPY | 0.84% | 0.71% | 0.61% | 0.89% | 0.74% | 0.51% | 0.32% | |

| CAD | 0.01% | -0.24% | -0.24% | -0.89% | -0.11% | -0.34% | -0.54% | |

| AUD | 0.10% | -0.22% | -0.21% | -0.74% | 0.11% | -0.32% | -0.52% | |

| NZD | 0.32% | 0.10% | 0.11% | -0.51% | 0.34% | 0.32% | -0.20% | |

| CHF | 0.54% | 0.29% | 0.30% | -0.32% | 0.54% | 0.52% | 0.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily digest market movers: The US Dollar extends losses as US fiscal worries return

- With geopolitical tensions in the rearview mirror, concerns about Trump’s Tax Bill, which is expected to add $3.3 trillion to the US fiscal debt load, have returned to the market. Fears of a debt crisis are eroding the idea of US exceptionalism and adding weight to the US Dollar.

- Eurozone manufacturing activity improved somewhat in June, with the PMI edging up to 49.5 from the previous month’s 49.4 reading. These figures are still consistent with a contracting trend, but they beat expectations of a steady 49.4 level and mark their highest level in the last three years.

- German unemployment increased by 11K in June, below the 15K expected, and well below May’s 34K increment. The jobless rate has remained steady at 6.3% against expectations of an increase to 6.4%.

- Preliminary Eurozone Consumer Prices Index (CPI) figures for June have confirmed steady inflation figures with prices ticking up to 2% year-on-year, from 1.9%, and the core inflation steady at 2.3% with both CPI readings flat on the month, broadly meeting market expectations.

- Trump has expressed his frustration about the trade talks with Japan, and Treasury Secretary Bessent warned that the US might introduce higher tariffs on July 9 despite ongoing negotiations.

- Regarding monetary policy, the US president has continued hammering the Fed Chair Powell, affirming that the US rate should be between Japan’s 0.5% and Denmark’s 1.75%. These comments raise questions about the independence of the central bank and undermine the US Dollar’s status as the world’s reserve currency.

- These attacks, along with the soft macroeconomic figures seen recently, have boosted investors’ expectations of Fed rate cuts for the rest of the year. The CME Group’s Fed Watch Tool shows a 20% chance of a rate cut in July, but a rate cut of at least 25 basis points (bps)in September is nearly fully priced.

- Tuesday’s focus will be on the Central Bankers Summit in Sintra, Portugal, where the chiefs of the world’s major central banks will speak about trade, the global economic outlook, and inflation, and might give hints about their rate paths.

- In Europe, the Preliminary Eurozone Consumer Prices Index (CPI) data from June will attract attention. Consumer inflation is expected to have remained steady, following cooler-than-expected CPI readings in Italy and Germany on Monday.

- In the US, the ISM Manufacturing PMI and the JOLTS Job Openings, together with Powell’s speech at the Sinttra summit, are expected to provide further clues about the bank’s rate cut calendar.

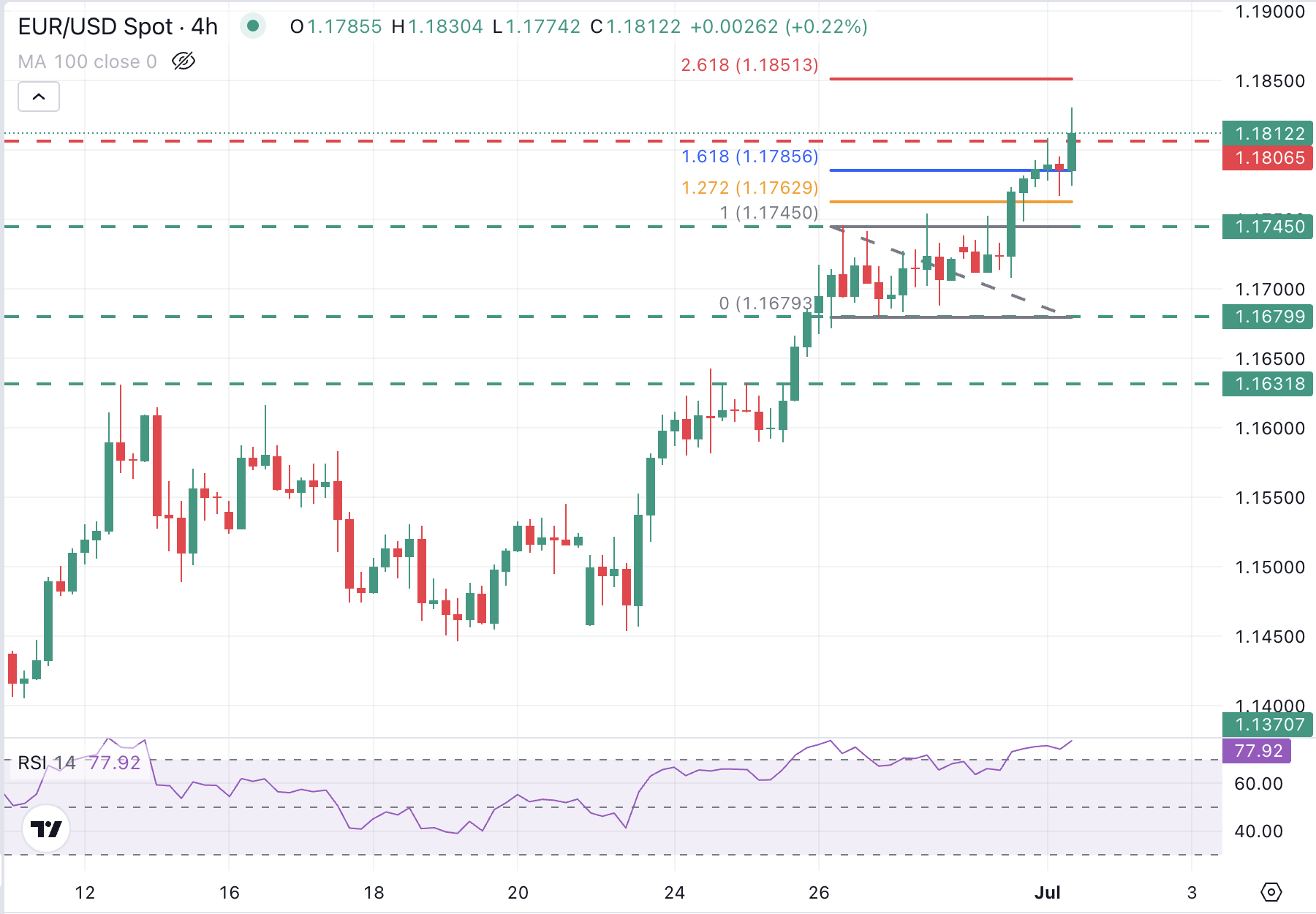

EUR/USD reaches overbought levels above 1.1800

EUR/USD trades slightly down, with the 4-hour Relative Strength Index (RSI 14) showing overbought levels as the pair extends above the 1.1800 area. This is often a sign of an upcoming corrective reaction.

On the downside, the previous high at 1.1750 (June 26 and 27 highs), is likely to provide some support to a stron

ger bearish reaction, ahead of the June 27 low at 1.1680

On the upside, above 1.1800 the 261.8% Fibonacci extension level of the June 26.30 trading range is at 1.1850, a plausible bullish target for today.