JPY/USD retreats slightly after retesting multi-month high against broadly weaker USD

- The Japanese Yen continues to benefit from US tariffs-inspired global flight to safety.

- Hopes for a US-Japan trade deal further underpin the JPY amid sustained USD selling.

- The divergent BoJ-Fed expectations support prospects for deeper USD/JPY losses.

The Japanese Yen (JPY) builds on strong intraday gains and retests the highest level since October 2024 against its American counterpart during the Asian session on Wednesday. Persistent worries about the potential economic fallout from US President Donald Trump’s sweeping trade tariffs continue to weigh on investors’ sentiment and benefit traditional safe-haven assets, including the JPY. Apart from this, reports that Trump has agreed to meet Japanese officials to initiate trade discussions fuel optimism about a possible US-Japan trade deal, which further underpins the JPY.

Furthermore, the growing acceptance that the Bank of Japan (BoJ) will continue raising interest rates amid broadening inflation in Japan turns out to be another factor lending support to the JPY. Meanwhile, bets that a tariffs-driven US economic slowdown might force the Federal Reserve (Fed) to resume its rate-cutting cycle soon mark a big divergence in comparison to hawkish BoJ expectations. This contributes to driving flows towards the lower-yielding JPY.

The USD/JPY pair, however, once again finds some support in the vicinity of mid-144.00s and climbs back above the 145.00 psychological mark in the last hour. Traders now look forward to the release of FOMC meeting minutes for some impetus ahead of the US consumer inflation figures on Thursday.

Japanese Yen buying remains unabated amid rising trade tensions and global recession fears

- Mounting worries that US President Donald Trump’s sweeping tariffs would push the US, and possibly the global economy, into recession this year have led to an extended sell-off in equity markets worldwide. In fact, the S&P 500 registered its steepest four days of losses since the 1950s after Trump unveiled sweeping reciprocal tariffs late last Wednesday.

- Japan’s Prime Minister Shigeru Ishiba and Trump agreed to keep dialogue open to address the pressing levy issues. Moreover, Trump told reporters that we have a great relationship with Japan and we’re going to keep it that way. This fuels optimism about a possible US-Japan trade deal, which lends additional support to the safe-haven Japanese Yen.

- Japan’s Ministry of Finance, Financial Services Agency, and the BoJ will hold meeting at 07:00 GMT to discuss international financial markets.

- Investors have pared their bets that the Bank of Japan will hike interest rates at a faster pace amid concerns about the potential economic fallout from Trump’s trade tariffs. However, BoJ Deputy Governor Shinichi Uchida said last Friday the central bank will keep raising interest rates if the chance of underlying inflation achieving its 2% target heightens.

- Meanwhile, investors now seem convinced that a tariffs-driven US economic slowdown would put pressure on the Federal Reserve to resume its rate-cutting cycle. According to the CME Group’s FedWatch Tool, the markets are currently pricing in over a 60% chance that the US central bank will lower borrowing costs at the next policy meeting in May.

- Moreover, the Fed is expected to deliver five interest rate cuts by the end of this year despite expectations that Trump’s tariffs will boost inflation. This, in turn, weighs on the US Dollar for the second straight day and keeps the USD/JPY pair within striking distance of its lowest level since October 2024 touched last Friday.

- Traders now look forward to the release of FOMC meeting minutes, due later during the US session this Wednesday. Apart from this, the US Consumer Price Index (CPI) and the Producer Price Index (PPI) on Thursday and Friday, respectively, might provide cues about the Fed’s rate-cut path. This, in turn, will drive the buck and USD/JPY.

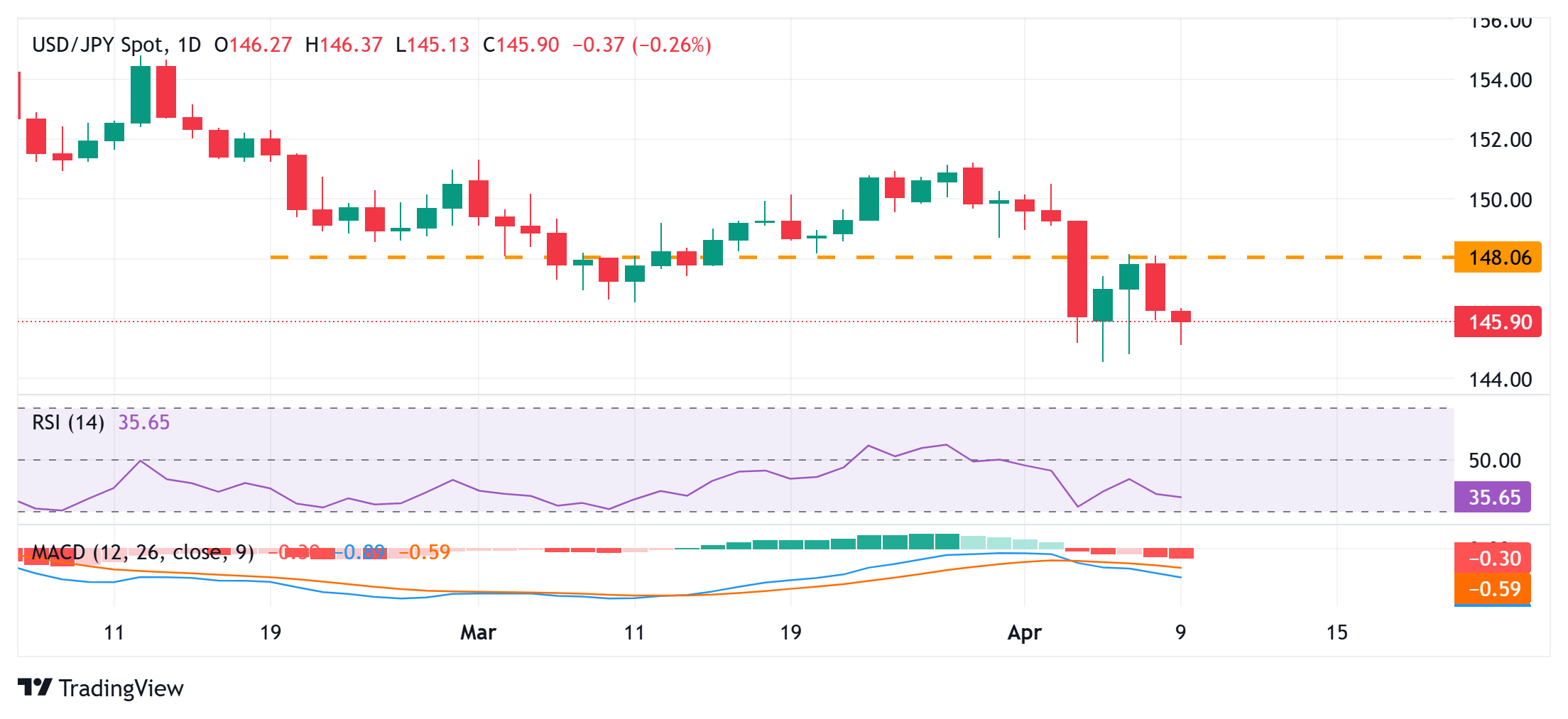

USD/JPY bears now await some follow-through selling below YTD low, around the 144.55 region

From a technical perspective, this week’s failure to find acceptance above the 148.00 mark and the subsequent fall favors bearish traders. Moreover, oscillators on the daily chart are holding deep in negative territory and are still away from being in the oversold zone, suggesting that the path of least resistance for the USD/JPY pair is to the downside. Some follow-through selling below the 145.00 psychological mark will reaffirm the negative outlook and expose the year-to-date low, around the 144.55 region touched on Monday, before spot prices eventually drop to the 144.00 round figure.

On the flip side, the 146.00 mark now seems to keep a lid on any attempted recovery. This is followed by the Asian session high, around the 146.35 region, above which a bout of a short-covering could lift the USD/JPY pair to the 147.00 round figure en route to the 147.40-147.45 area. The subsequent move-up should allow bulls to reclaim the 148.00 mark and test the weekly top, around the 148.15 zone. A sustained strength beyond the latter might shift the near-term bias in favor of bullish traders and pave the way for some meaningful appreciating move.