Trade of The Day – AUDUSD

Facts:

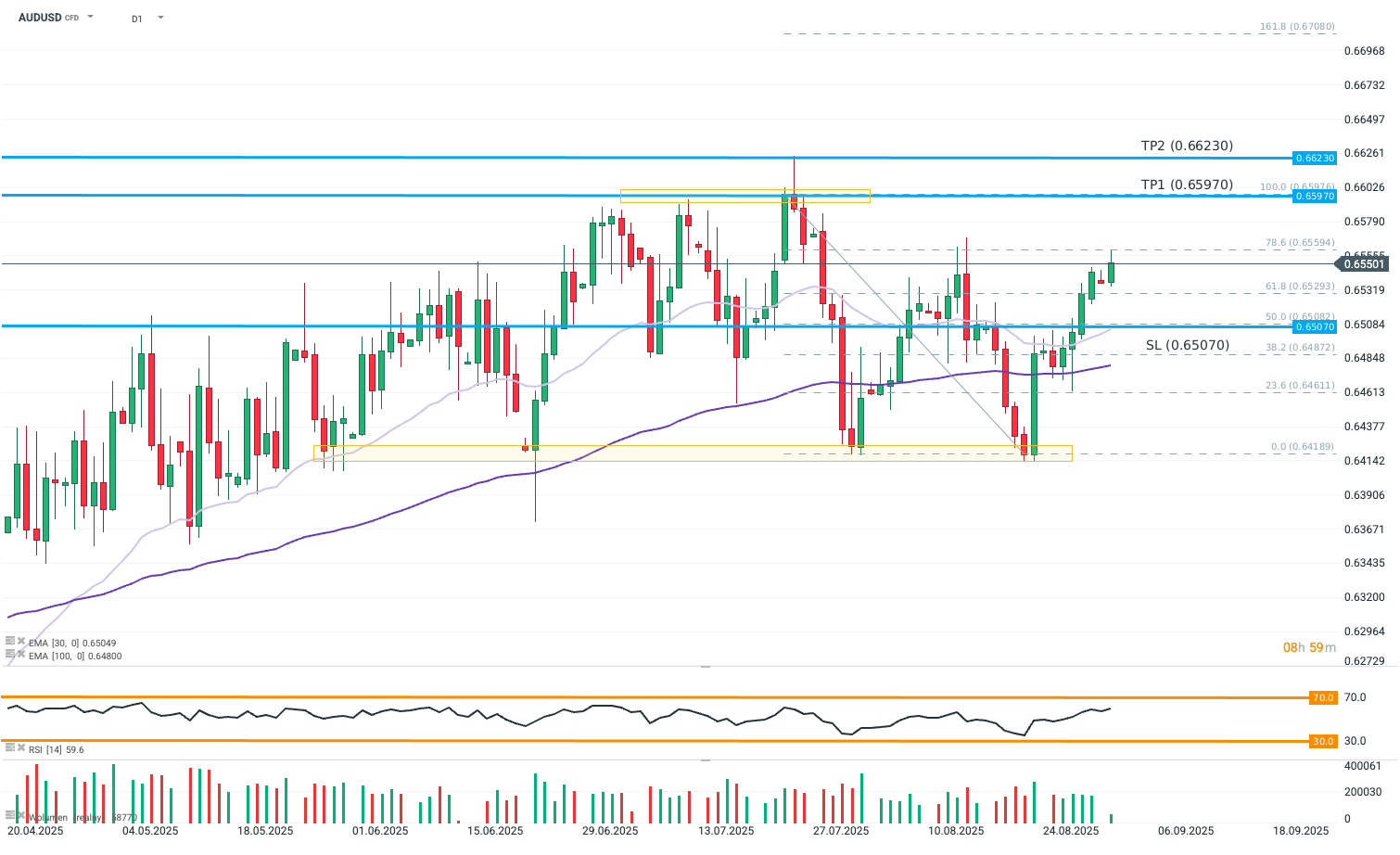

- AUDUSD is trading above the 30- and 100-day exponential moving averages (EMA30 – light purple, EMA100 – dark purple).

- A U.S. federal appeals court ruled that the reciprocal tariffs imposed by Donald Trump were illegal, i.e., an abuse of the president’s emergency decision-making prerogative.

- Australia’s monthly CPI rose to its highest level since July 2024 (2.8%), while China’s Caixin Manufacturing PMI climbed above expectations to 50.5 (forecast 49.7, previous 49.5).

Recommendation:

- Long position (BUY) on AUDUSD at market price.

- Target price (Take Profit; TP): 0.65970 (TP1), 0.66230 (TP2).

- Stop Loss (SL): 0.65070.

Source: xStation5

Opinion:

The Australian dollar stalled today at the 78.6 Fibonacci retracement level of the current consolidation on the D1 timeframe, but broad USD sentiment indicates mounting downward pressure on the dollar. In addition, buyers are clearly defending the 0.65500 level, with AUD additionally supported by stronger Chinese activity data and a higher CPI print in Australia.

The market is eagerly awaiting this week’s series of employment-related data, which are especially important ahead of the upcoming Fed decision. The nearest report will be tomorrow’s ISM Manufacturing Index. While the overall reading is expected to rise from 48 to 49, the employment sub-index has been in a downtrend for months (last at 43.4). Further weakness would reinforce expectations of a dovish Fed (the swap market currently prices in an 88% chance of a 25 bp cut in September), thereby weighing on the USD. Meanwhile, the Reserve Bank of Australia will likely be more cautious about further easing after the recent inflation jump to 2.8% y/y.

In the medium term, the dollar will also be burdened by disputes between Trump and the Federal Reserve (Lisa Cook’s lawsuit) as well as uncertainty related to tariffs, which the appeals court deemed mostly illegal over the weekend. Eroding confidence in the USD is also reflected in the ongoing rally in precious metals (gold, silver).

Methodology

The recommendation is based on technical analysis of the AUDUSD chart and fundamental analysis of the respective economies (interest rates). The recommendation’s direction was determined by moving averages (shorter above longer; uptrend), capital outflow from USD due to institutional factors, and expected market reactions to monetary policy paths in Australia and the U.S.

Take Profit levels were determined using Fibonacci retracement and Price Action methodology. Stop Loss was set slightly below the 50% Fibonacci retracement of the current consolidation, which coincides with the 30-day exponential moving average (EMA30, light purple). TP1 was set at the upper boundary of the consolidation, while TP2 was placed at the local high broken on July 24.