U.S. Wheat Making Headlines

The wheat market had a good start yesterday following reports that Bangladesh signed a five-year agreement to buy 700,000 tons of U.S. wheat each year. U.S. wheat exports for the 2025/26 marketing year are forecast to be 850 million bushels, up 25 million bushels from last month and the highest since 2020/21, according to the United States Department of Agriculture (USDA) Economic Research Service. This increase is driven by a strong pace of export sales and larger domestic supplies.

Historically, a significant portion of Bangladesh’s imports came from the Black Sea region, particularly Russia and Ukraine, due to lower costs. U.S. wheat prices are competitive and the deal provides a more stable supply chain while strengthening trade relations with the U.S. More headlines like this could help wheat trade higher.

Meanwhile, Russia kept its wheat export tax at zero for the third week in a row due to expectations of a strong 2025 harvest and to boost Russian wheat exports after the harvest. This could increase competition in global markets and potentially lower prices. Romanian and Bulgarian wheat prices moved up to a one-month high last week. Perhaps U.S. wheat prices will follow suit.

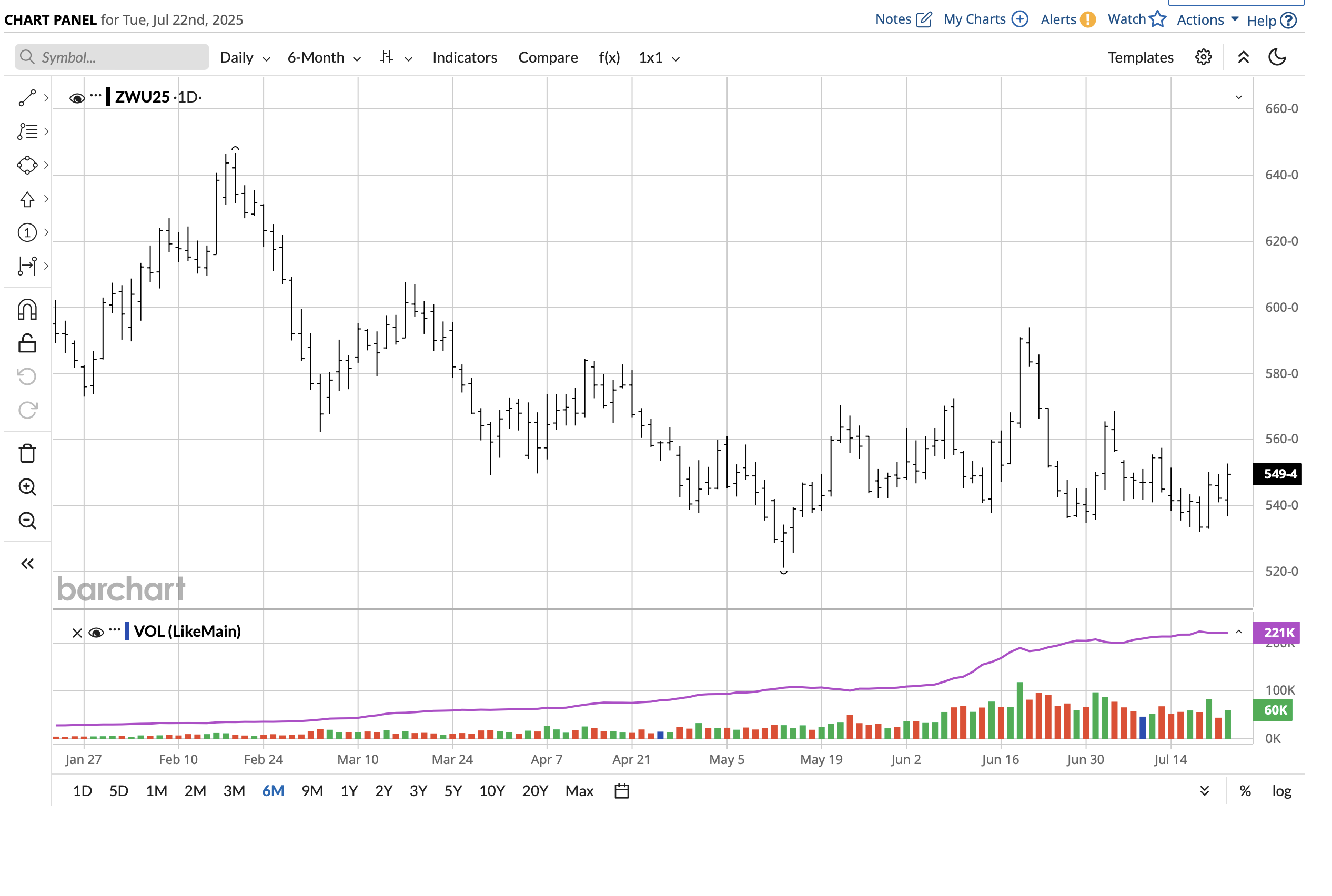

One futures trade strategy would be to buy September wheat now at today’s settlement price of 549½ or better. Risk the trade to 539½ stop ($500 risk per contract). Profit objective is 569½. Maintenance margin on wheat is $1600. Risking one to make two is appealing, in my opinion.

An option trade strategy would be to sell three September wheat 530 puts at 7.2 each. With this premium you bring into your account, buy one September wheat 590 call at 22 ½. So the three September puts that you sell will pay for the one September wheat you buy. The expiration date for the September wheat options is August 22.

If wheat can rally in the next week or two, the September wheat options could be worthless. Then you can be long December wheat 590 the rest of the year.