XAU/USD climbs as Fed remarks, US ISM data, and trade uncertainty in focus

- Gold price surges as investors look to key speeches from central bank officials.

- Fed Powell, ECB President Lagarde, BoJ Governor Ueda, and BoE Governor Bailey speak at the ECB forum in Portugal.

- XAU/USD tests the 20-day SMA near $3,350 with bulls eager to retest $3,400.

Gold prices climbed on Tuesday as investor attention shifted to a high-profile gathering of global central bankers in Portugal.

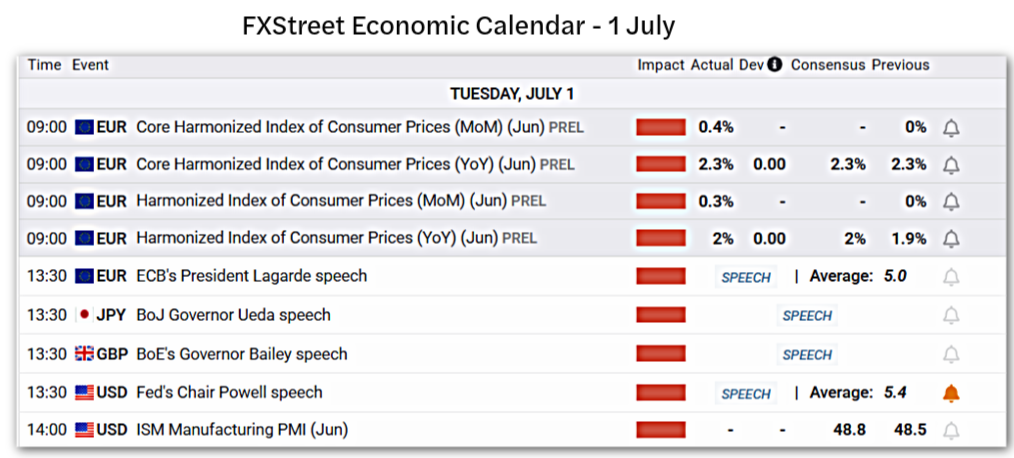

At the time of writing, XAU/USD is holding firm above the $3,300 mark, with prices hovering above $3,350 ahead of key policy remarks expected at 13:30 GMT.

Global policymakers gather at the ECB forum, a key event for Gold

The focus on Tuesday is on the European Central Bank (ECB) Forum on Central Banking, currently underway in Sintra, Portugal. This rare convergence of the world’s top central bankers offers a critical opportunity for markets to assess the direction of global monetary policy.

ECB President Christine Lagarde, Bank of Japan (BoJ) Governor Kazuo Ueda, Bank of England Governor Andrew Bailey, and Federal Reserve Chair Jerome Powell are scheduled to speak.

The joint appearance is more than symbolic. Previous Forums have triggered coordinated messaging or revealed stark divergences in policy outlooks that have moved major asset classes, including Gold, currencies, and bonds.

With central banks navigating a delicate balance between inflation control and slowing growth, any nuance in today’s remarks could set the tone for the third quarter.

Gold patiently waits for remarks from Powell ahead of US Manufacturing ISM report

Markets will be tuned into Powell’s speech, given the rising political tensions in the United States.

President Donald Trump’s escalating criticism of Powell, including another sharply worded post on Truth Social on Monday, has raised concerns about the Fed’s independence.

Trump’s post read, “Jerome – You are, as usual, ‘too late.’ You have cost the USA a fortune – and continue to do so – you should lower the rate by a lot!”

The rhetoric has fueled speculation that Powell may either shift his tone or face replacement.

That prospect has pressured real yields lower and driven fresh demand for Gold as a hedge against policy uncertainty and US Dollar weakness.

Volatility is expected to rise on Tuesday if policymakers’ tone alters expectations for interest rates or the economic outlook.

Additionally, the release of the US Institute for Supply Management Manufacturing Purchasing Managers Index (ISM Manufacturing PMI) is scheduled for 14:00 GMT.

Gold daily digest market movers: XAU/USD rallies on monetary, fiscal, tariff concerns

- The ISM Manufacturing PMI is expected to print at 48.8 for June. A reading below 50 signals contraction. If confirmed, it could reinforce expectations of a slowing US economy, a backdrop that typically supports Gold. However, an upside surprise could lift sentiment and boost demand for the Greenback, placing short-term pressure on Bullion.

- President Trump issued a handwritten note with his signature to Fed Powell on Monday. The letter said that “Hundreds of billions of dollars are being lost! No inflation”.

- Many now expect a shift toward looser monetary policy, which is putting downward pressure on real yields and making Gold more attractive.

- At the same time, the Trump administration’s proposed “Big Beautiful Bill,” with its estimated $3.3 trillion impact on the deficit, is sparking fears over long-term fiscal health.

- The bill has drawn fire from across the political spectrum, including from Elon Musk and several Democratic leaders, who warn it could lead to inflation and a weaker US Dollar. Such a backdrop often prompts investors to turn to Gold as a hedge against instability and currency depreciation.

- With a July 9 tariff deadline fast approaching, the US is focusing on smaller, step-by-step trade deals rather than sweeping agreements, aiming to avoid triggering new tariffs.

- While partial progress has been made with countries like the UK and China, talks with Japan and the European Union are still unsettled. The EU has shown openness to a blanket 10% tariff but is pushing for exceptions in sensitive sectors such as semiconductors and pharmaceuticals.

- Meanwhile, President Trump has taken aim at Japan’s trade approach, especially on rice, warning that new tariffs may be imposed if no deal is reached in time.

- Trump expressed his frustration on Monday following a dispute over Japan’s reluctance to import rice from the US, which resulted in the US President stating that Japan has been “spoiled with respect to the United States of America.”

- All of this contributes to an environment where Gold looks relatively safe. Add to that the possibility of technical breakouts and increased buying interest, and it’s no surprise prices are pushing higher.

Gold technical analysis: XAU/USD bounces off trendline support, opening the potential for a retest of $3,400

After falling to trendline support from the January low on Monday, failure to gain traction below $3,250 allowed bulls to regain control of the imminent trend. With the 50-day Simple Moving Average (SMA) currently providing support for the yellow metal at $3,320, XAU/USD is now threatening a break of the 20-day SMA at $3,351. The 23.6% Fibonacci retracement of the April low-high move provides an additional barrier of resistance near $3,371.

The Relative Strength Index (RSI) is currently at 52, rising back above the neutral zone and pointing higher. This suggests a modest bullish bias. With the Gold price threatening the 20-day SMA, a clear break of $3,351 and a move above $3,371 could see prices retest the major psychological level of $3,400.

Gold (XAU/USD) daily chart

If bullish momentum fades and prices slip below $3,300, the 38.2% Fibo level could come into play at $3,292, with a deeper pullback driving Gold to the midpoint of the April move at $3,328.