- The Indian Rupee opens flat around 88.85 against the US Dollar.

- India’s Commerce Secretary Agarwal commented that the higher tariff issue with the US has almost resolved.

- Investors await the US NFP data for September.

The Indian Rupee (INR) opens on a flat note against the US Dollar (USD) on Tuesday. The USD/INR pair continues to trade in a tight range around 88.85, with investors remaining on the sidelines as the United States (US) and India have still not reached a trade deal, despite having negotiations from a long period.

The US has been charging 50% tariffs on imports from India, of which 25% is reciprocal levy and the rest is imposed for buying Oil from Russia, from a few months that are notably impacting the amount of goods exported to Washington.

According to research from BofA Securities, exports from India to the US shrank 12% in September due to higher tariffs.

Meanwhile, recent commentaries from US President Donald Trump and India’s top trade negotiator Rajesh Agarwal have indicated that both nations are close to reaching a consensus soon. On Monday, Commerce Secretary Rajesh Agarwal stated that the first part of the bilateral trade deal with the US is “nearly closure”, which addresses 50% tariffs and market access to the US, and the finalized deal will be announced on a mutually decided date, PTI reported.

Last week, US President Trump stated that Washington and New Delhi are close to a bilateral pact, but didn’t provide a timeframe. Trump said at “some point” he would reduce the tariff rate on Indian goods, saying the US was getting “pretty close” to a trade deal with New Delhi, Bloomberg reported. He added, “Right now they don’t love me, but they’ll love us again,” and “We’re getting a fair deal”.

Daily digest market movers: Investors shift focus to US NFP data

- The Indian Rupee remains in a limited range between 88.50 and 89.00 against the US Dollar since the start of the month. However, a range breakthrough looks likely soon as the US Bureau of Labor Statistics (BLS) is set to release the official labour market data for September on Thursday.

- The impact of the official employment data will be significant for the US Dollar and market expectations for the Federal Reserve (Fed) monetary policy outlook, as major economic releases were halted due to the government shutdown.

- Ahead of the US Nonfarm Payrolls (NFP) data, Fed officials have been expressing rising job market risks. On Monday, Fed Governor Christopher Waller said that the US central bank should cut the interest rates in the December meeting, citing a slowdown in the hiring trend.

- “I am hearing that firms are paying for ai investment by not hiring, and firms say low-and-middle income households are not spending, hitting hiring, which makes case for continuing interest rate cuts,” Waller said.

- Similarly, Fed Vice Chair Philip Jefferson has also warned of downside employment risks, but has warned caution on further rate cuts, citing that policy is somewhat closer to the neutral level. “Balance of risks has shifted in recent months, with increased potential downside to employment, but the Fed needs to proceed slowly as monetary policy approaches the neutral rate,” Jefferson said at an event hosted by the Fed Bank of Kansas City.

- At press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades marginally lower to near 99.45. The USD Index gained sharply on Monday as traders have trimmed bets supporting another interest rate cut this year. According to the CME FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points (bps) to 3.50%-3.75% in the December meeting has diminished to 43% from 62.4% seen a week ago.

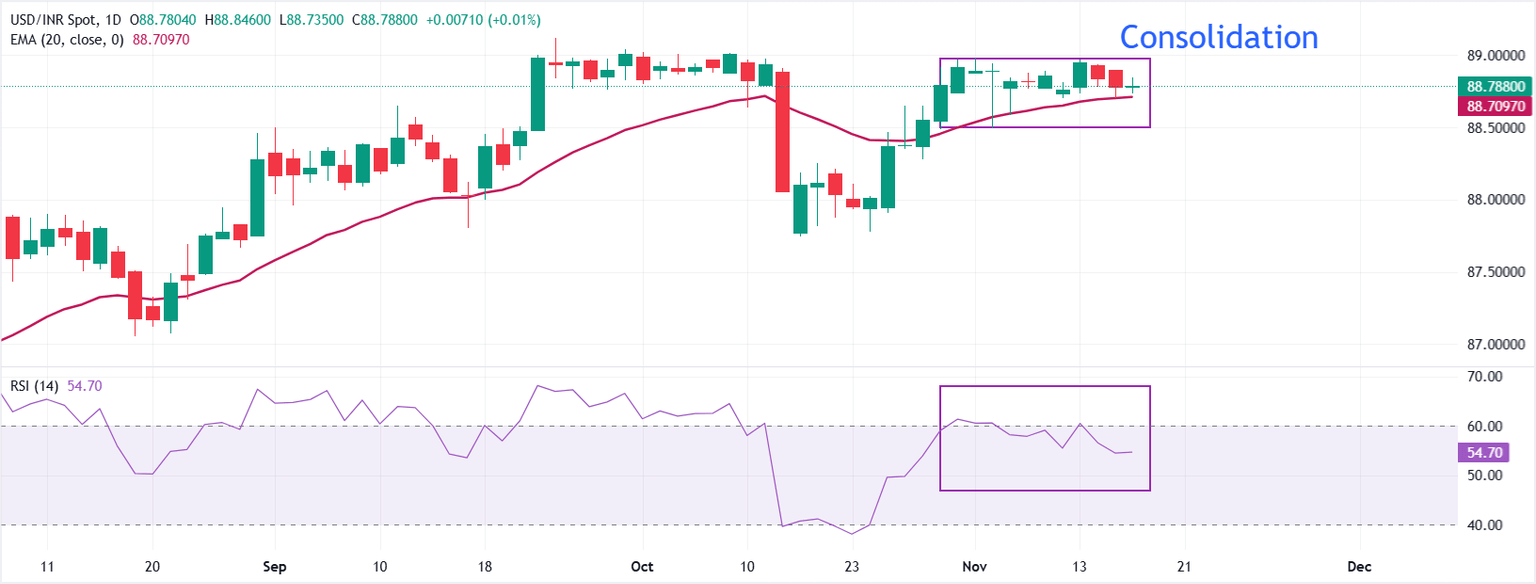

Technical Analysis: USD/INR stays sideways below 89.00

USD/INR remains sideways below 89.00 for over two weeks. The 20-day Exponential Moving Average (EMA) near 88.70 continues to act as key support for the USD bulls.

The 14-day Relative Strength Index (RSI) struggles to return above 60.00. A fresh bullish momentum would emerge if the RSI (14) manages to do so.

Looking down, the August 21 low of 87.07 will act as key support for the pair. On the upside, the all-time high of 89.12 will be a key barrier.

Leave A Comment