- The Indian Rupee trades cautiously against the US Dollar due to rising oil price and consistent FIIs outflow.

- Oil price rallies amid civil unrest in Iran, acting as a major drag on the Indian currency.

- Investors await India-US CPI data for December.

The Indian Rupee (INR) opens on a cautious note against the US Dollar (USD) at the start of the week. The USD/INR pair trades firmly near the weekly high of 90.66 as the Indian Rupee underperforms due to rising oil prices and the continued outflow of foreign funds from the Indian stock market.

Currencies from economies that rely heavily on oil imports to cater to their energy needs, face heavy selling pressure in a high crude oil price environment.

Global oil prices have rallied almost 6% since Thursday amid fears of supply disruption, following the civil unrest in Iran, which has resulted in deaths of almost 500 civilians. “There have also been calls for workers in the oil industry to down tools amid the protests,” analysts at ANZ said in a note, Reuters reported, which puts “at least 1.9 million barrels per day (bpd) of oil exports at risk of disruption”.

Meanwhile, consistent selling by Foreign Institutional Investors (FIIs) in the Indian equity market is keeping the Indian Rupee under pressure. So far in January, FIIs have offloaded their stake worth Rs. 11,786.82 crore. Overseas investors have been rigorously paring their stake in the Indian stock market amid trade frictions between the United States (US) and India.

On the domestic front, investors await India’s retail Consumer Price Index (CPI) data for December, which will be published at 10:30 GMT. The inflation report is expected to show that price pressures grew at a faster pace of 1.5% Year-on-year (YoY), faster than 0.71% in November.

Daily Digest Market Movers: Indian Rupee drops against US Dollar on renewed Trump-Powell feud

- The Indian Rupee trades lower against the US Dollar, even as the latter corrects sharply, following the criminal charges against Federal Reserve (Fed) Chair Jerome Powell.

- At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.12% to near 99.10. The DXY corrects after revisiting the monthly high of 99.25.

- The Fed was filled with subpoenas on Friday from the US Department of Justice threatening criminal charges against Jerome Powell over his comments in his Senate testimony last June, which concerned “multiyear renovation of historic buildings at an estimated cost of $2.5 billion”.

- In response, Fed Chair Powell has stated that he has “carried out my duties without political fear or favor and will continue to do so”, and the “new threat is not about his testimony or the renovation project but a pretext”. Powell clarified that criminal charges against him are a “consequence of Fed setting interest rates based on our assessment of the public interest rather than the president’s preferences”.

- In the past, US President Trump has criticized Fed’s Powell several times for not reducing interest rates aggressively.

- Going forward, investors will focus on the US CPI data for December, which will be released on Tuesday. The impact of the US inflation data will be significant on the Fed’s monetary policy outlook. Economists expect US core inflation to rise at a faster pace to 2.7% YoY from 2.6% in November, with headline figures growing steadily by 2.7%.

- On Friday, lower-than-projected US jobless rate and strong wage growth measure boosted the appeal of the US Dollar. The Nonfarm Payrolls (NFP) report showed that the Unemployment Rate fell to 4.4% from 4.6% in November, while it was expected to drop to 4.5%. Average Hourly Earnings, a key measure of wage growth, grew at an annualized pace of 3.8%, faster than expectations and the prior reading of 3.6%.

Technical Analysis: USD/INR aims to hold above 20-day EMA

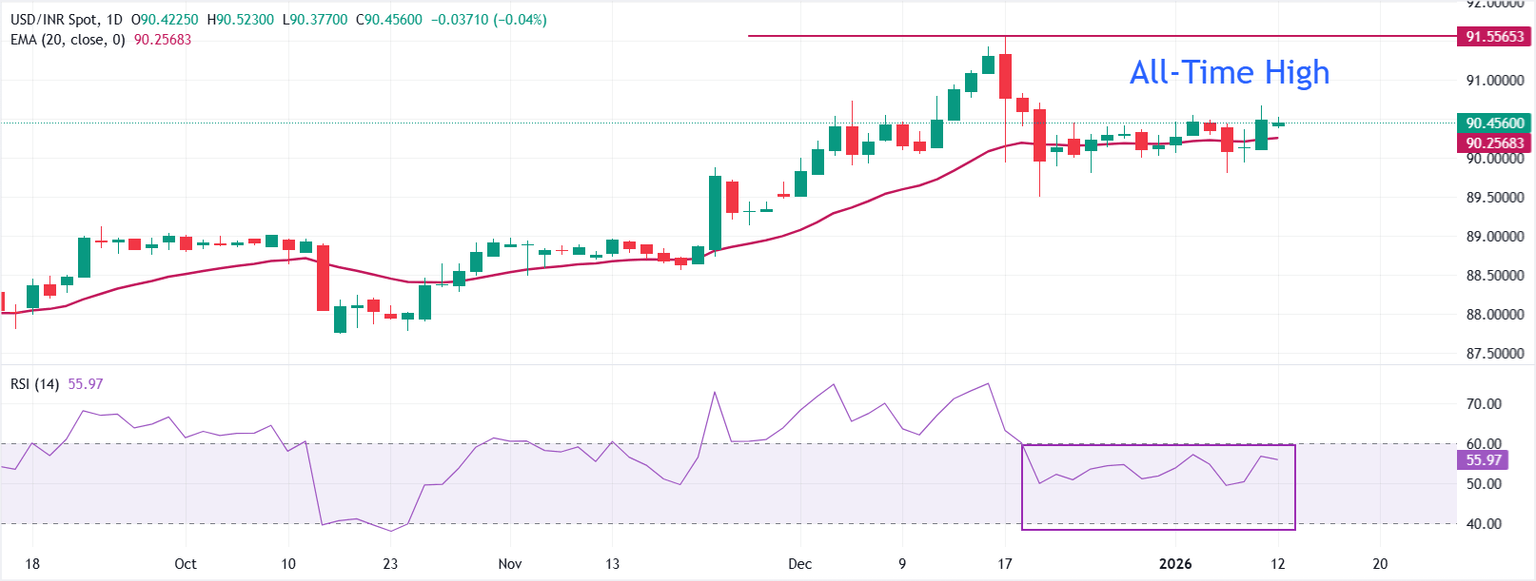

In the daily chart, USD/INR trades at 90.4665. Price holds above the rising 20-EMA at 90.2578, keeping the short-term bias skewed to the upside as the average edges higher. RSI at 56 (neutral) reflects steady momentum without overbought pressure, allowing room for continuation while above the average.

Pullbacks would be expected to find initial support at the 20-EMA at 90.2578. A decisive break below would tilt risk toward consolidation rather than trend extension. As long as RSI remains above 50, dips should remain contained and rallies could extend. A drop back below 50 would warn of fading momentum.

Leave A Comment