RBA held the cash rate steady at 3.6% in a unanimous decision amid renewed inflation pressures and a tight labor market. Governor Michele Bullock stated the board has no predetermined stance on future rate moves, emphasizing data dependency and uncertainty.

Key headlines:

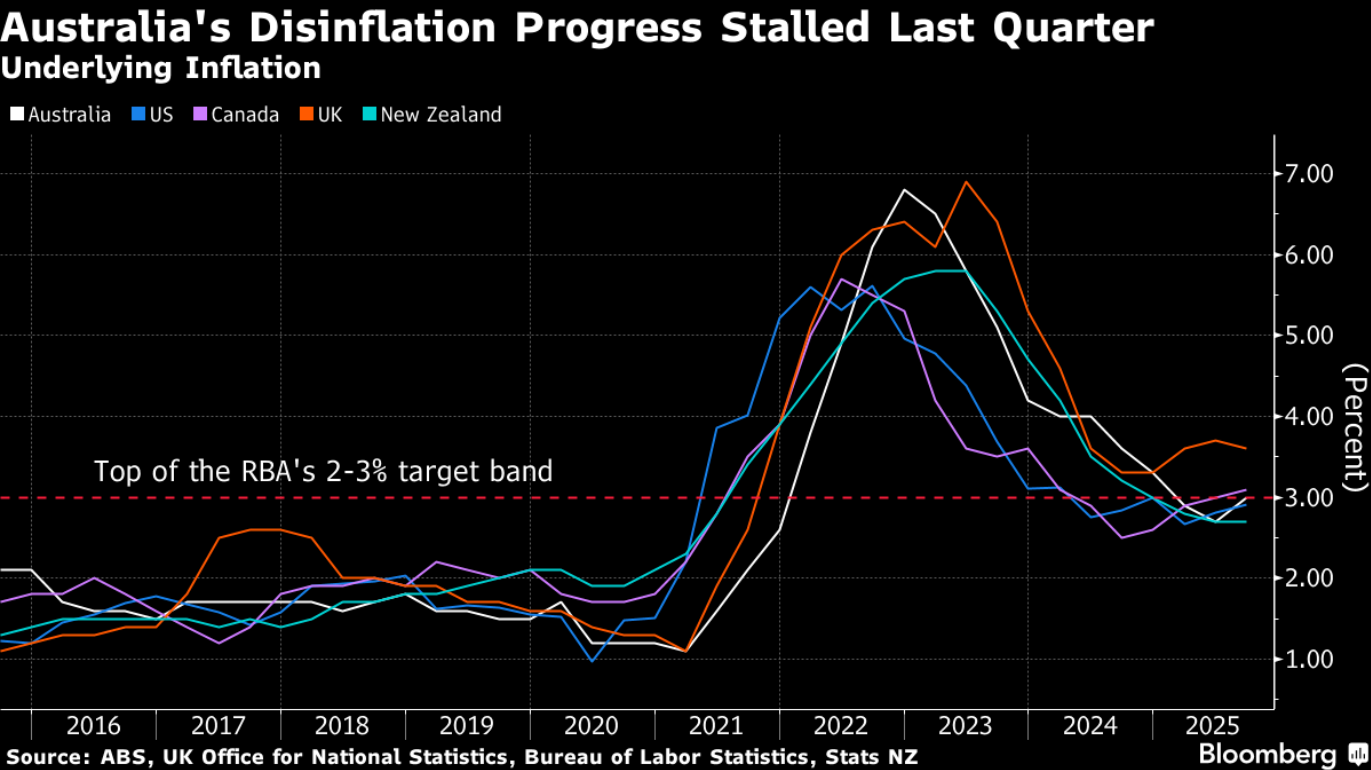

- Core inflation is expected to remain above 3% over the coming year, with some inflationary pressures considered temporary.

- Mixed economic data include record high housing prices and credit growth, contrasting with manufacturing decline and rising unemployment at 4.5%.

- Bullock highlighted the labor market remains somewhat tight despite the unemployment rise and confirmed no rate increase was planned at this meeting.

- International risks include geopolitical tensions and trade uncertainties, though recent tariff truce has eased concerns.

- The RBA targets inflation at 2.5%, balancing price stability with sustainable full employment.

Governor Michele Bullock emphasized that the board has no predetermined stance on future policy moves, highlighting considerable uncertainty around inflation’s trajectory and the broader economic outlook. She noted that while some inflationary pressures may be temporary, core inflation is expected to stay above 3% over the coming year, and the question remains about the extent and timing of any future rate cuts.

The disinflation process has recently come to a general halt, undermining the rationale for a rapid focus on lowering interest rates in major economies. Source: Bloomberg Financial Lp

Following the RBA announcement, the Australian dollar (AUD) posted one of the worst intraday performances among developed-market currencies. The cautious tone and unchanged rate decision combined with external headwinds pressured the AUD below 0.6550 versus the USD. Market participants remain wary about Australia’s growth prospects and the timing of potential future rate cuts, keeping downside risks elevated. Technical support is eyed around 0.6500, with further guidance expected from upcoming economic data and RBA communications.

Today, the AUDUSD pair is testing the 200-day EMA (the gold curve on the chart), which has so far been a key foundation for the ongoing long-term uptrend. If the pair manages to stabilize above this zone, there is a chance that this trend will continue. Source: xStation

The material on this page does not constitute financial advice and does not take into account your level of understanding, investment objectives, financial situation or any other specific needs. All information provided, including opinions, market research, mathematical results and technical analyzes published on the Website or transmitted To you by other means, it is provided for information purposes only and should in no way be construed as an offer or solicitation for a transaction in any financial instrument, nor should the information provided be construed as advice of a legal or financial nature on which any investment decisions you make should be based exclusively To your level of understanding, investment objectives, financial situation, or other specific needs, any decision to act on the information published on the Website or sent to you by other means is entirely at your own risk if you In doubt or unsure about your understanding of a particular product, instrument, service or transaction, you should seek professional or legal advice before trading. Investing in CFDs carries a high level of risk, as they are leveraged products and have small movements Often the market can result in much larger movements in the value of your investment, and this can work against you or in your favor. Please ensure you fully understand the risks involved, taking into account investments objectives and level of experience, before trading and, if necessary, seek independent advice.

Leave A Comment