- EUR/USD tumbles 0.75% as Kevin Warsh’s Fed nomination boosts US yields and Dollar demand.

- Hot US producer inflation reinforces the Fed’s steady-rate stance, lifting Treasury yields above 4.25%.

- Strong German and Eurozone GDP data fail to offset Dollar strength driven by policy repricing.

EUR/USD drops during the North American session, down by 0.75% amid a session characterized by overall US Dollar strength, sponsored by Trump’s mild-hawkish pick to lead the Federal Reserve and an inflation report that warrants steady rates by the Federal Reserve. At the time of writing, the pair traded at 1.1882 down from daily highs of 1.1974.

Euro sinks below 1.19 as hawkish Fed leadership signals and sticky inflation crush rate-cut hopes

Kevin Warsh is Trump’s election to be the next Fed Chairman of the Federal Reserve, confirming rumors that leaked late on Thursday. The financial markets sent precious metals tumbling, while the Dollar nearly 1% according to the US Dollar Index (DXY), which tracks the buck’s performance against six peers.

The DXY is poised to end the day past the 97.00 figure. US Treasury yields rose with the 10-year yield rose nearly one basis points at 4.25%.

In addition to Warsh naming, US inflation in the producer side edged higher, distancing from the Federal Reserve’s 2% goal, justifying the Fed’s decision. Aside from the release of the Producer Price Index (PPI) figures for December, speeches by Federal Reserve officials grabbed the headlines.

Breaking news revealed that the US Senate reached a deal to get the government funding package through chamber tonight, averting a shutdown, according to Politico.

US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up one and a half basis points at 4.247% as of writing.

In Europe, the German economy rose by 0.4% YoY exceeding estimates. Better-than-expected Gross Domestic Product (GDP) figures in Germany and the Eurozone, and the uptick in German inflation, have failed to provide any significant support to the pair.

Next week, the US economic docket will feature a tranche of US jobs data, speeches by Fed officials and the ISM Manufacturing and Services PMIs for January. In Europe, HCOB Flash PMIs for the bloc and for Germany and France, and the European Central Bank monetary policy meeting, could trigger some volatility in the EUR/USD pair.

Euro Price This Month

The table below shows the percentage change of Euro (EUR) against listed major currencies this month. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.85% | -1.48% | -1.10% | -0.59% | -4.17% | -3.85% | -2.44% | |

| EUR | 0.85% | -0.69% | -0.18% | 0.32% | -2.98% | -2.95% | -1.53% | |

| GBP | 1.48% | 0.69% | 0.51% | 1.03% | -2.31% | -2.28% | -0.85% | |

| JPY | 1.10% | 0.18% | -0.51% | 0.42% | -3.01% | -3.24% | -1.24% | |

| CAD | 0.59% | -0.32% | -1.03% | -0.42% | -3.41% | -3.64% | -1.85% | |

| AUD | 4.17% | 2.98% | 2.31% | 3.01% | 3.41% | 0.03% | 1.50% | |

| NZD | 3.85% | 2.95% | 2.28% | 3.24% | 3.64% | -0.03% | 1.47% | |

| CHF | 2.44% | 1.53% | 0.85% | 1.24% | 1.85% | -1.50% | -1.47% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily market movers: The Dollar’s comeback, tumbles the Euro

- St. Louis Federal President Alberto Musalem stated that the central bank does not need to cut interest rates further at this time, as the current 3.50%-3.75% policy rate range is roughly at a neutral level. He said further reductions would only be justified if the labor market deteriorates sharply or inflation drops materially

- Fed Governor Stephen Miran said Kevin Warsh would be an excellent choice for the Fed, adding that the recent rise in producer prices has been driven mainly by housing costs and portfolio management fees.

- Meanwhile, Christopher Waller noted that the labor market remains weak despite steady economic growth. He argued that inflation would be close to 2% were it not for tariffs, which he said kept price growth near 3%, and added that monetary policy should be closer to neutral, around 3%.

- Atlanta Fed President Raphael Bostic urged patience on policy, saying rates should remain somewhat restrictive. He warned that the full inflationary impact of tariffs has yet to materialize and expects price pressures to remain persistent.

- The US Bureau of Labor Statistics showed Producer Price Index (PPI) inflation held steady at 3.0% YoY in December, unchanged from November and missing expectations for a slowdown to 2.7%. Core PPI, which excludes food and energy, accelerated to 3.3% YoY from 3.0%, defying forecasts for a decline to 2.9%, underscoring continued upstream price pressures.

- Gross Domestic Product (GDP) for the last quarter of last year in the European Union expanded by 1.4% YoY, unchanged from Q3, but above forecasts of 1.2%. In Germany the economy in Q4 exceeded estimates of 0.3%, rose by 0.4% YoY, up from Q3 0.3% growth.

- Germany’s inflation in January as measured by the Harmonized Index of Consumer Prices (HICP) ticked a tenth up from 2% to 2.1%, but within the European Central Bank’s target.

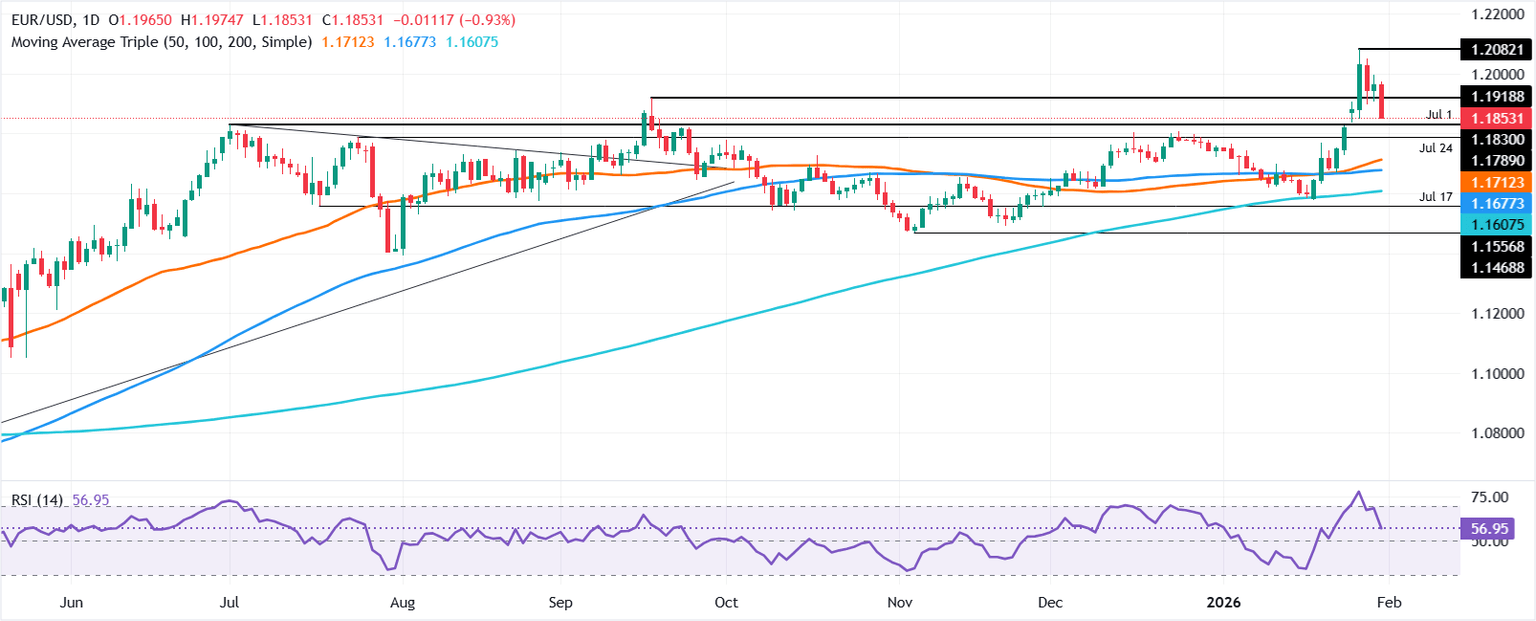

Technical outlook: EUR/USD uptrend at risk, after diving below 1.1850

The EUR/USD technical picture shows that the uptrend is at risk after breaching 2025 yearly high of 1.1918, exacerbating a drop below 1.1850. The Relative Strength Index (RSI) showed that momentum shifted mildly bearish, which could pave the way for further downside in the pair.

In that outcome, the EUR/USD next support would be 1.1800 which if gives way, can send the pair to the 20-day SMA at 1.1743.

On the flip side, the EUR/USD first resistance is 1.1900. If reclaimed, the next key resistance would be 1.1950 followed by the yearly peak at 1.2082.

Leave A Comment