- The Pound Sterling trades calmly near 1.3500 against the US Dollar ahead of the release of the FOMC minutes.

- Investors expect the Fed to deliver at least 50 basis points interest rate cuts in 2026.

- US President Trump said that he will announce Fed Powell’s successor in January.

The Pound Sterling (GBP) trades flat around 1.3500 against the US Dollar (USD) during the European trading session on Tuesday, close to an over three-month high of 1.3535 posted last week. The GBP/USD pair consolidates as the US Dollar wobbles ahead of the release of Federal Open Market Committee (FOMC) Minutes of the December meeting, which will be published in the late New York session.

At the press time, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades flat around 98.00.

Investors await the FOMC minutes to get detailed cues on policymakers’ views on the monetary policy outlook. In the last policy meeting, the Fed delivered its third interest rate cut of year, pushing them lower to 3.50%-3.75%. The Fed’s Summary of Economic Projections, which included the dot plot, showed that policymakers collectively see the Federal Funds Rate heading to 3.4% by the end of 2026. This suggests that there will be only one interest rate cut next year.

The projected reduction in interest rates by the Fed in 2026 is lower than what market participants are anticipating. According to the CME FedWatch tool, traders are extremely confident that the Fed will cut borrowing rates by at least 50 basis points (bps) before 2026 ends.

Daily digest market movers: BoE guides gradual easing cycle

- The Pound Sterling has been trading broadly firm against its major peers over the past few weeks in anticipation that the Bank of England (BoE) will slow down the pace of reducing interest rates in 2026.

- In the policy meeting earlier this month, the BoE reduced interest rates by 25 bps to 3.75% and guided that the monetary policy will remain on a gradual downward path.

- The BoE retained a gradual monetary easing outlook as the United Kingdom (UK) inflation has remained well above the 2% target, even after cooling down in the past two months. UK headline inflation has decelerated to 3.2% in November from the peak of 3.8% recorded in September.

- In 2026, the major driver for BoE market expectations will be UK labor market conditions and the Gross Domestic Product (GDP) growth prospects. UK labor demand remained weak in 2025 as employers restricted hiring to offset the impact of the increase in their contribution to social security schemes.

- In the US, the major trigger at the beginning of 2026 would be the announcement of Fed Chair Jerome Powell’s successor by the White House. On Monday, United States (US) President Donald Trump stated that he will announce the new Fed Chair sometime in January. The Fed’s new chairman is expected to favor aggressive monetary easing, as Trump said last week that he wants the new central bank chief to lower interest rates even if the market is doing well.

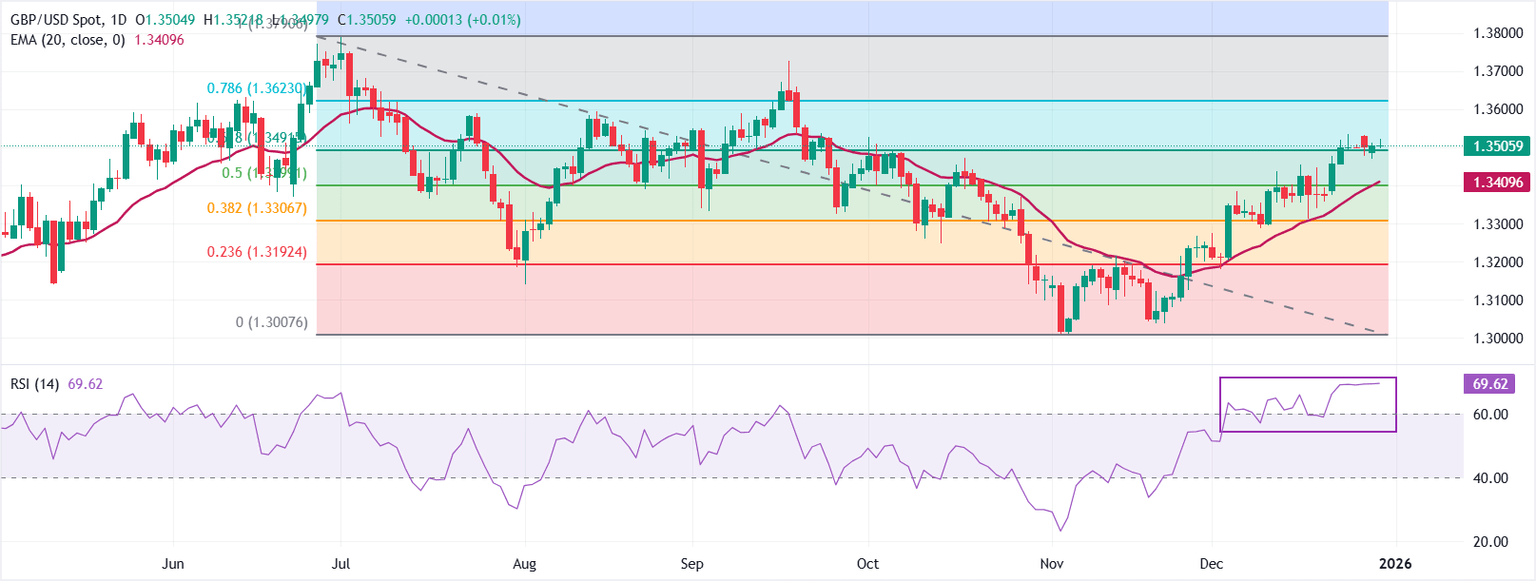

Technical Analysis: GBP/USD holds key 20-day EMA

In the daily chart, GBP/USD trades at 1.3506. The 20-day exponential moving average rises and price holds above it, reinforcing a bullish bias. The RSI at 69 is near overbought territory, which could slow the advance. Measured from the 1.3791 high to the 1.3008 low, the 61.8% retracement at 1.3491 has been overcome, and the next resistance sits at the 78.6% retracement at 1.3623.

Momentum would remain firm while the pair remains above the rising average, with dips expected to find support around that dynamic line. A daily close through the 1.3623 barrier could open a run toward higher highs, whereas rejection there would keep the pair ranging and encourage a pullback to relieve stretched momentum.

Leave A Comment