Facts:

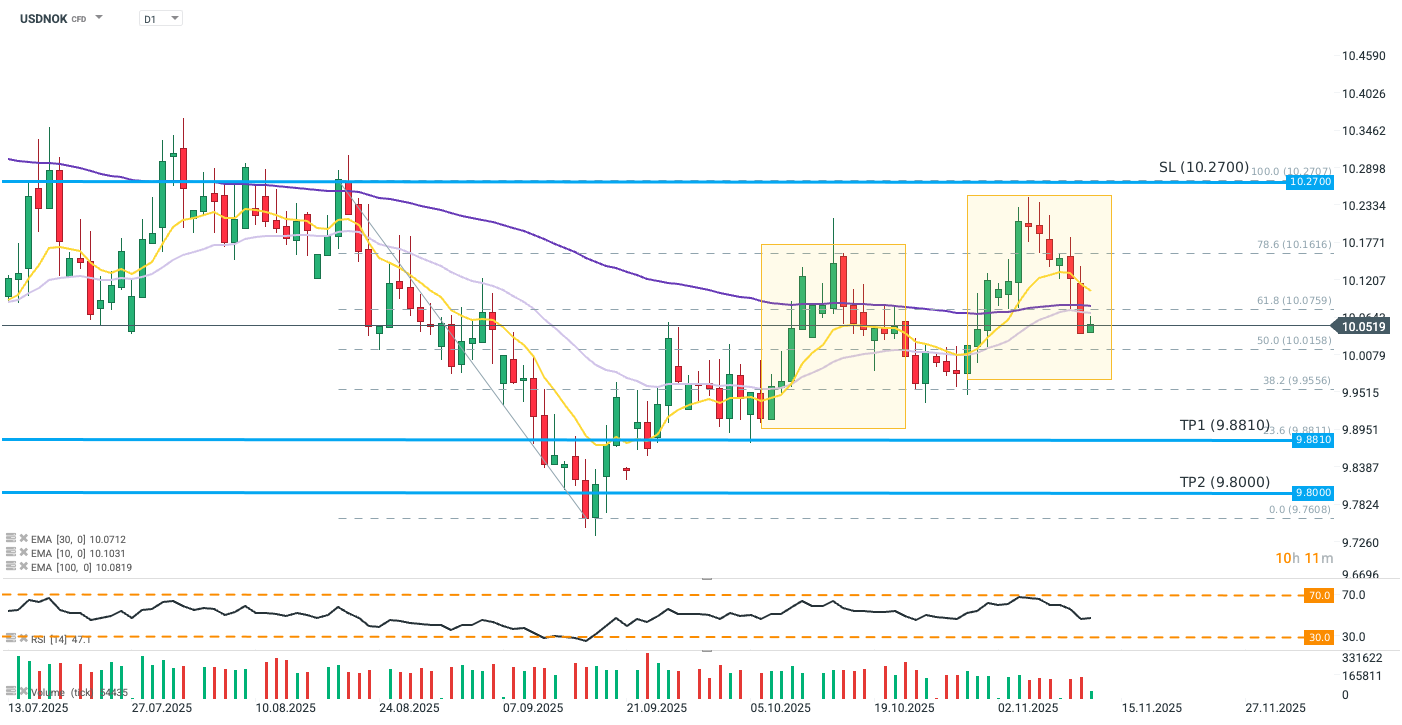

- The USDNOK exchange rate has fallen below its 10-, 30-, and 100-day exponential moving averages (EMA; yellow, light purple, dark purple respectively), with today’s gains halted just before the EMA30.

- Norway’s core CPI inflation unexpectedly rose to 3.4% in October (Bloomberg consensus: 3.0%).

- The CME FedWatch Tool indicates a rise in the expected probability of a December U.S. rate cut.

Recommendation:

- Short position (Sell) on USDNOK at market price

- Target price (Take Profit; TP): 9.8810 (TP1), 9.8000 (TP2)

- Stop Loss (SL): 10.2700

Source: xStation5

Opinion

The USDNOK is breaking out of its recent upward wave after the Norges Bank’s announcement last week of a pause in further rate cuts, erasing over half of the gains recorded following Jerome Powell’s hawkish FOMC comments. Downward pressure on the pair was intensified by Monday’s higher-than-expected Norwegian CPI reading (core: 3.4% vs Bloomberg consensus: 3.0%).

While the hawkish stance of Norges Bank may already be priced in, the sticky core inflation and expanded government spending plans for 2026 should continue to limit expectations for monetary easing in Norway, thereby supporting the NOK. Meanwhile, markets have begun to reprice expectations for a December Fed rate cut — the previously balanced 50/50 odds after the last FOMC have now risen to nearly 65% (source: CME FedWatch) — suggesting that Fed expectations may continue to exert downward pressure on the USD.

From a technical perspective, the main risk to the short bias lies within the scope of the recent price structure. To maintain a downward momentum, the pair would need to remain below overlapping EMA and the 61.8% Fibonacci retracement level and not pause at the lower boundary of the geometry.

Methodology

This recommendation is based on technical analysis of the USDNOK chart and fundamental analysis of both economies (monetary policy). The trade direction was determined using exponential moving averages and price action (EMA crossover confirmation), along with market expectations ahead of the upcoming FOMC meeting. Take Profit and Stop Loss levels were defined using Price Action methodology and Fibonacci retracement levels — TP1 near the 23.6% level, TP2 slightly above the local bottom, and SL at a repeatedly tested resistance zone.

Employees of the Analysis Department, as well as other persons involved in the preparation of this report do not have any knowledge about positions of Today Markets in financial instruments. In addition, Trading Department employees are not taking part in preparation of reports and/or market commentaries.

There is a conflict of interest between TM and the Client resulting from the fact that TM draws up General Recommendations regarding the Financial instruments, which TM also has in its offer. In addition, if as a result of the General recommendation obtained, the Client concludes a transaction in TM, there is a conflict of interest in that TM will be the other party to the transaction entered into by the Client. TM takes the appropriate steps to minimize the impact of this conflict of interest.

Leave A Comment