- The Indian Rupee regains ground against the US Dollar after a three-day losing streak.

- The US Dollar’s safe-haven demand cools down as the US-Venezuela clash risk subsides.

- So far in January, FIIs have sold shares worth Rs. 3,015.05 crore in the Indian stock market.

The Indian Rupee (INR) trades positively against the US Dollar (USD) on Tuesday after a three-day losing streak. The USD/INR pair corrects to near 90.35 as the US Dollar Index (DXY) falls back sharply after posting a fresh over-a-three-week low at 98.86 on Monday. The Greenback has come under pressure as the risk-off sentiment has subsided, leading to a decline in demand for safe-haven assets.

On Monday, the US Dollar gained sharply as the market sentiment turned risk-averse, following the United States (US) strike on Venezuela and the capture of President Nicolas Maduro over drug-trafficking charges.

Meanwhile, the outlook of the Indian Rupee remains fragile due to renewed trade frictions between the US and India, and the consistent outflow of foreign funds from the Indian stock market.

On Monday, US President Donald Trump threatened to increase tariffs on India further if it continues buying Oil from Russia. “We could raise tariffs on India if they don’t have help on Russian Oil issue,” Trump said.

On the foreign flows front, overseas investors continue to dump their stake in the Indian equity market. Foreign Institutional Investors (FIIs) have offloaded their stake worth Rs. 3,015.05 crore in the first three trading days of January. However, the amount of shares sold on Monday was worth Rs. 36.25 crore, significantly lower than the average selling.

Daily Digest Market Movers: US Dollar falls back due to weak US Manufacturing PMI

- A sharp pullback move in the US Dollar is also driven by surprisingly weak US ISM Manufacturing Purchasing Managers’ Index (PMI) data for December on Monday.

- The data showed that the Manufacturing PMI contracted again at a faster pace to 47.9 from 48.2 in November. Economists expect the data to come in marginally higher at 48.3. The data also showed that sub-components of the manufacturing sector, such as New Orders Index and Employment, also declined, but at a moderate pace.

- Continuously declining manufacturing sector activity has raised concerns over the US economic outlook.

- This week, the major trigger for the US Dollar will be the Nonfarm Payrolls (NFP) data for December, which will be published on Friday.

- Investors will pay close attention to the US official employment data to get fresh cues on the current state of the job market. In 2025, the Federal Reserve (Fed) delivered three interest rate cuts and pushed them lower to 3.50%-3.75% to support weakening labor market conditions.

- This year, UBS expects the Fed to cut interest rates in July and October. Investment banking-to-financial services led firm has pushed expectations from January and September, citing that the core Consumer Price Index (CPI) could rise 44 basis points (bps), 50 bps, and 30 bps in December, January, and February, respectively.

- On Wednesday, investors will closely monitor ADP Employment Change and the ISM Services PMI data for December, and the JOLTS Job Openings data for November.

Technical Analysis: USD/INR struggles to break above 90.50

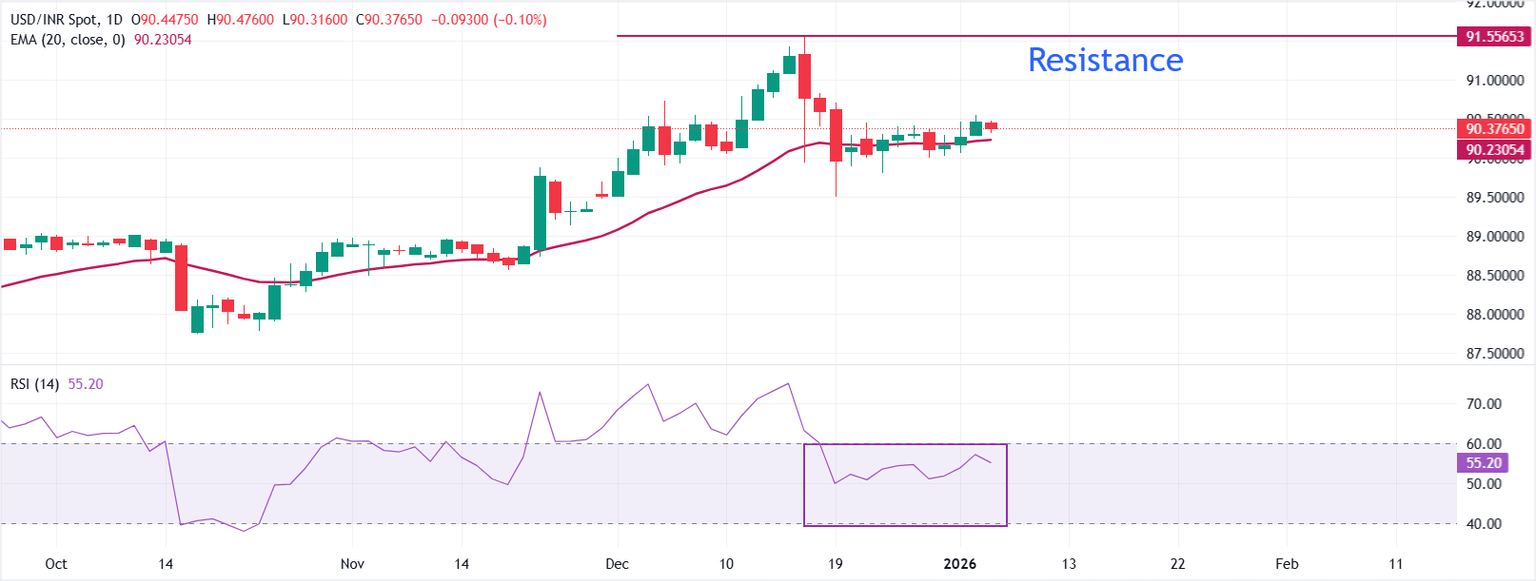

In the daily chart, USD/INR trades at 90.3765. The pair holds above the rising 20-day Exponential Moving Average (EMA at 90.2305, which supports the broader uptrend after the recent pullback. The slope of the average has flattened, yet price action continues to respect it as dynamic support.

The 14-day Relative Strength Index (RSI) at 55.20 (neutral) signals steady momentum without overbought pressure, keeping the near-term bias mildly positive.

Momentum would improve on sustained closes above the short-term average that could create the opportunity for the pair to revisit the all-time high at 91.55. On the contrary, a daily close back under the 20-day EMA average would turn bias down and open room for further retracement towards the December low of 89.50.

Leave A Comment